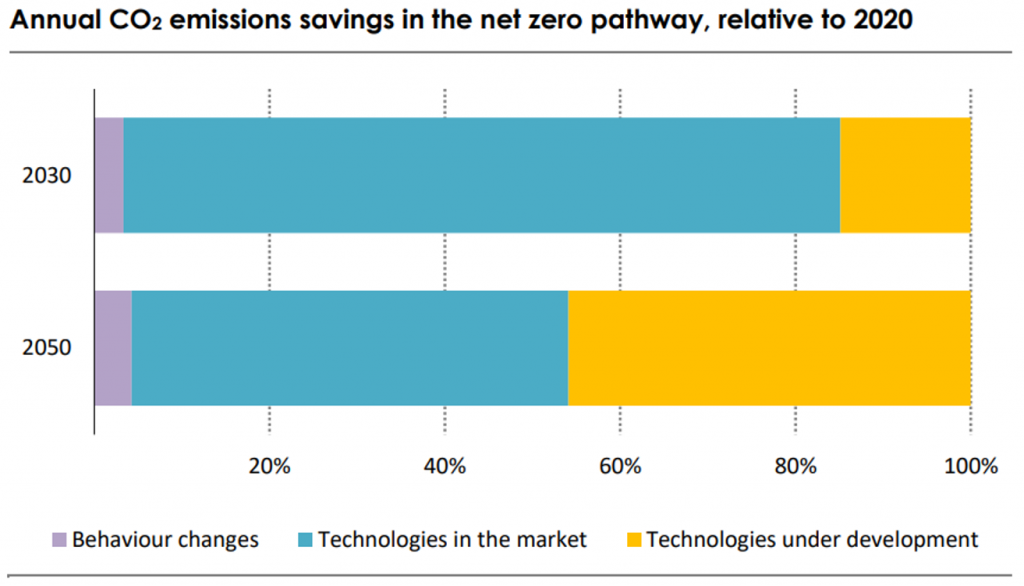

The International Energy Agency (IEA) recently published Net Zero by 2050: A Roadmap for the Global Energy Sector. The IEA makes the case that in order to reach net zero by 2050, we need to accelerate the development and deployment of clean technologies by 2030 – essentially, we should be focusing our efforts today on technologies already in the market, as well as technologies that are market-ready.

For reference, let’s look at where photovoltaics and lithium-ion batteries were 10 years versus today. This is the kind of support innovation needs today, but faster.

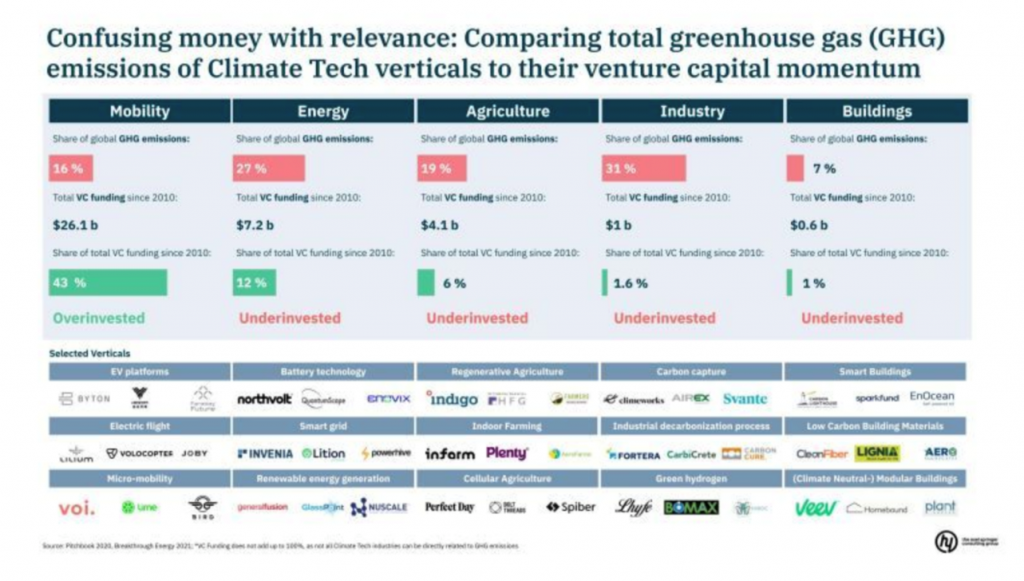

There are two questions I am thinking about when it comes to venture capital investing in climate positive technologies:

1) What technologies can become mass market ready by 2030 (or sooner), and

2) What do we need to do to get to net zero?

What technologies can become mass market ready by 2030?

Yair Reem from Extantia has mentioned that (green) hydrogen, sustainable aviation fuel (SAF), long-duration energy storage (LDES), and direct air capture (DAC) are the next technologies to reach price parity: “These are the technologies that will be on par by 2030 because they are no longer in the R&D/lab-scale phase. We see and invest in companies that are now building the first demo plants that will pave the road for commercial-scale plants. Considering it takes to 2-3 years to build a plant, we expect to have mature competitive technologies by the end of the decade.”

What do we need to do to get to net zero?

To reach net zero, we need to assess risk differently and innovate the financial mechanisms to fund innovation. By nature of the traditional 10-year lifetime of venture capital firms, they should figure out how to make somewhat riskier investments in technologies that need incubation time to reach affordability. Yair added that “The venture industry has the responsibility to take nascent technology and make it bankable so that the project finance can come in.” Not all tasks have the same sense of urgency, and some innovations, such as a renewable energy grid, are enablers for other technologies such as green hydrogen.

Meanwhile, to help technologies break into the market in the near term, new ways to assess risk and finance deployments are necessary.

Outlook

We can’t solely rely on financially supporting climate positive technologies to reach net zero. We will also need policy and behavior change. Governments should be incentivizing individuals and businesses to make climate positive decisions by making climate negative choices less attractive, while incentivizing their replacements. Throughout this process, we’re going to become more conscious consumers. I believe that consumer behavior will account for more of the transition to net zero than the 4% that the IEA states. 4% is extremely low, especially when we are at a point in time where investors and organizations are paying attention to ESG more than ever before, and where consumers are demanding more sustainable practices.

Additional Credits: Thank you to Extantia for contributing to this article.

About The Author

Daniel currently works at Lawrence Livermore National Laboratory. His original assignment was to maintain and update facility safety documentation for all facilities on-site, and perform risk analysis. Over time, his role has expanded to leading continuous improvement efforts through product management.

Concurrently, Daniel volunteers with Techstars, helping organize startup weekends, and with the American Institute of Chemical Engineers, organizing events on the local and national levels of the organization. He also volunteers with One World, and previously with Powerhouse Ventures, to source and screen startups for potential investment.

Daniel holds a BS in Chemical Engineering from UC Davis, and recently completed coursework in energy innovation from Stanford. His passion is at the intersection of sustainability, innovation, and business.