Howdy 👋

Big newsletter this week. Lots of amazing content for you to read. Enjoy.

Oh – and if you’re interested in a podcast episode…I recommend this one 🙃

– Swarnav S Pujari

In Your Inbox: A guest from Freewire on how to reduce EV infrastructure; Understanding plastic recycling; How CalWave makes wave power more affordable; How consumers can build ESG portfolios

The number of electric vehicles (EVs) on the road is expected to reach 130 million in 2030.

Many organizations are rushing to figure out how to install direct current fast chargers (DCFC) to meet the rising demand for EV charging. Cities, retailers, universities, corporate campuses, and other entities will benefit by providing EV charging as a service. Still, they can get discouraged by the logistical and financial complexities of pursuing an EV charging project.

Here are the three main cost drivers for DCFC projects and discuss how site hosts can reduce these barriers of entry to meet the global transition to electric transportation.

To meet the high power demands of modern charging stations, site hosts need to consider the power availability at their site before committing to a DCFC project.

Many DCFCs require 480 V power to accommodate fast charging. Upgrading to 480 V power can add tens to hundreds of thousands of dollars to your project and creates additional complexities related to installation and site permitting. Site hosts should consider coordinating with the utilities early in the project process as it can take months to procure and install necessary supporting equipment. Power upgrades can require a new transformer on the site, resulting in lost land or parking spaces, which may force site hosts to redesign the layout of their parking lot.

The following are three considerations when installing DCFC infrastructure and the corresponding impact on your bottom line.

DCFC hardware cost can vary greatly based on quality, features, and power output. Cost generally increases with power output; therefore a 350 kW charger can be significantly more expensive than a 50 kW charger.

Some DCFC models include integrated energy storage (FreeWire’s Boost Charger) or feature attached solar panels among other offerings. When deciding which hardware to go with, I recommend site hosts consider the following questions when considering DCFC hardware:

The following are three considerations when selecting DCFC hardware and the corresponding impact on your bottom line.

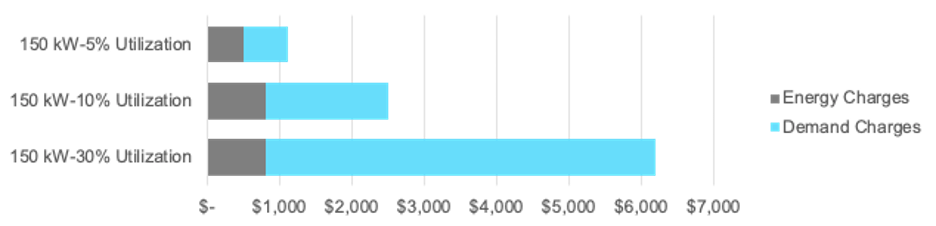

DCFC stations are capable of delivering a high power charge, from 50 kW to over 300 kW of power to EVs, fully charging vehicles in 30 minutes or less. In states such as California, Massachusetts, New York, Colorado and Florida, where pulling large amounts of energy at peak times is costly, DCFCs can become a significant operating expense for site hosts. Rocky Mountain Institute (RMI) noted in their DCFC rate design study that demand charges triggered by DCFC EV charging sessions constitute a significant barrier to the business viability of owning and operating DCFCs.

The following are three ways to address your charger operating expense and the corresponding impact on your bottom line.

Sign up for The Impact and learn the perspectives behind the latest sustainability trends

Circularity Fast Facts: The Big Picture of Plastic Recycling

Plastic isn’t the only thing we recycle. Glass, paper and aluminum can all be recycled. So why do we only hear about issues with plastic? There are several reasons plastic is the problem child of recycling.

Plastic is very stable. I’m not talking about stable as in a relationship, looking at you Oprah and Stedman. I’m talking about chemically stable.

Think about it this way, whales, camels and fish have all been found with plastic in their stomach. This means even stomach acid has trouble breaking down plastic! Plastic’s robust nature comes from its chemical structure of long molecular chains, called polymers. It is exactly this chemical robustness which makes plastic a blessing and a curse. Plastic is an incredible material with almost infinite uses in our everyday lives but its stability makes it challenging, if not, impossible to recycle.

To explain this more, let’s dive into the two main types of plastics starting with thermoplastics. Thermoplastics will melt under heat, hence the name thermo. Examples of thermoplastics are grocery bags, plastic water bottles, and all other “1 to 7” category plastics. A thermoplastic will behave similarly to butter in a hot pan; it melts. Thermosets, on the other hand, become stronger with heat. A thermoset is more like an egg in a pan; it hardens with heat and once it is cooked, it cannot go back to its former state. Examples of thermosets are computer keyboards and parts in aerospace and automobile applications.

There are challenges with both thermoplastics and thermosets when it comes to recycling due to their chemical stability.

Very rarely can plastic truly be recycled and this is due to the chemical stability of the long molecular chains we talked about earlier. You can imagine the chemical structure of a thermoplastic like a long chain of people holding hands.

When a thermoplastic is recycled, it is traditionally heated to break it down. And it does exactly that, it breaks down the molecular chains (imagine several of these people drop their hold on each other). This makes the plastic weaker.

That’s why thermoplastics cannot be “recycled” (a plastic water bottle makes another plastic water bottle). Instead, they are typically “downcycled” (made into another product) or thrown in the landfill or ocean. Thermoset plastics, on the other hand, cannot be melted at all because they become stronger with heat (like the egg in the pan). There are few end of life options for these plastics so they are simply broken down into smaller pieces or thrown in the landfill.

We talked about why plastics are physically difficult to recycle but what about the consumer’s role in recycling?

You may have heard this term wish-cycling. It means throwing something in the recycling bin in the hope it will be recycled but in reality it cannot be. Recycling, like all other manufacturing, is an industry. It requires profit and labor and resources to operate. When things are put in the recycling bin that cannot truly be recycled (some typical items would be plastic utensils, plastic grocery bags or ziplock bags) it slows down the entire recycling process sometimes forcing the hauler to throw away the entire load of recycling because it is not worth their time to sort out the contamination.

This means that when we recycle something that cannot be recycled, the entire load of material is jeopardized.

I am of the opinion that plastic itself is not the enemy, but rather the way we think about plastic.

Plastic’s chemical stability makes it an incredible material for applications where we need such a dependable and robust material, such as in the aerospace or automobile industry. But when we use this remarkably stable material for a single use it makes me feel, to quote Mugatu in Zoolander, “like I’m taking crazy pills.” There is no reason to use a material which is so robust for a single use. In my mind, there are three things we need to do to shift our mindset around plastics:

Plastic is a useful material thanks to its chemical stability. Let’s learn to treat it like something that will be around forever… because it will be.

After last week’s discussion of what wave power is and why it is important to the renewable energy ecosystem and the green transition, I got the opportunity to chat with Marcus Lehmann, CEO and Co-Founder of CalWave, about he and his team plan seek to change the tides of the Blue Economy.

“Wave power is the third largest renewable resource after wind and solar in the US. We can provide power at night in the wintertime where other renewables can’t, and so far it is completely underutilized. The Department of Energy recently published a study of an updated resource assessment and found that wave power can provide up to 30% of the 2019 energy consumption in the US. That is the technical potential no just the theoretical, so it’s already been reduced to what can be practically used.”

Wave power hasn’t received the same attention or growth until recently. “Unlike wind and solar projects, wave energy collectors and other ocean technologies are unable to be iteratively grown for several reasons. The cost to test wave technology is too high to do rapid iterations and experiments on the technology. Additionally, without many facilities to field test large-scale prototypes, it becomes extremely difficult to find a place to collect the proper data.”

“It takes time for these technologies to grow. It takes a village to get these technologies to make a substantial contribution like 5-10% of total electricity consumption. If we want these scale by 2035, we really need to double down on the progress we have made. The next step to get these technologies to mature to utility-scale. PacWave is the first grid-connected wave farm that can be used as a development case by project developers to be replicated in the long run.”

“Permitting has been a prohibitive issue that has restricted wave testing. Pacific Gas & Electric (PG&E) wanted to build a wave testing, the Central Coast WaveConnect Project, but ultimately abandoned the project in 2011 due to permitting risks. With PacWave having secured pre-approved permits, significant impediments have been resolved for future wave tests, including CalWave’s.”

Ocean-based solutions have an enormous unused potential for mitigating climate change. While the Ocean Based Climate Solutions Act was introduced but never voted on, it does show that a changing political agenda is more focused on climate change, as is evident in the Biden administration. Ocean-based energy solutions include wave and tidal power, as well as non-energy related technology like aquaculture and algae-based products.

“CalWave’s technology operates fully submerged. This allows our product to be closer to the shore and is less of an issue for people who are concerned about the individual impact of seeing a system floating in their waters.”

“We have approached wave energy from a system engineering perspective. Wave energy devices are no different than wind turbines. It’s a infrastructure that project that captures a renewable resource to product electricity. At the highest level, the functions to make a project worthwhile are the product needs to be technically efficient and capital efficient. To be technically efficient, we must be able to use the most of a resource to produce the greatest amount of electricity. For us, capital efficiency means that the system must be able to shut down autonomously. By having this autonomous function, the cost of removing or sheltering the system from storms and significant weather events is nullified. This is what was often lacking in the first generation of wave energy devices.”

“Therefore, by incorporating three key mechanisms into our technology lowering capital costs and removing key obstacles from play in weather events, we have made an efficient system without overdesigning it so that it does not become prohibitively expensive. “

“The biggest challenge to ocean and wave technology is to build up confidence in the performance and reliability of the technology that can only be achieved through field testing and real-world data. We have our first open ocean pilot at Scripps in San Diego and we have received funding from the Department of Energy (DoE) to prepare for PacWave when the South Site officially opens for testing.”

“Even with securing trust and confidence in the technology, the key to scaling rests in project financing. To achieve project financing, the project must be bankable and will need several insurances to counterbalance the inherent risks of deploying new energy technology. This is still an unknown path, as there is no guidance or precedence to know how many hours of how much data is required for a project to become bankable. For comparison, wind energy required there to be enough turbines in the field. From there, gradual process was made to get to where both onshore and offshore wind are today.”

“It is important to note that to accelerate the growth of wave energy, certain steps on the process cannot be skipped. This includes having field tests experience as many weather events as possible, including severe events that only occur in the winter. Therefore, the minimum testing period of any product in this sector is a year to capture all aspects of every season. Fortunately for CalWave, there is commercial interest, but that testing is pivotal to getting their product to market.”

“We really see our short-term impact being in small island development states. They still heavily rely on diesel imports and represent 11% of the global population yet diesel has emissions as high as coal in terms of CO2/kWh. Their space is constrained and even with wind and solar ,hurricanes are a constraint there as well. Tourism is one of their biggest industries so having a renewable resource that works completely underwater and doesn’t take up space while providing power close to baseload is a great opportunity for these communities.”

“Wave energy can greatly benefit the integration and efficiency of offshore wind. With more cables going into the grid, wave power can upgrade wind farms by providing an additional source of power during excess demand, or provide power when the wind is not blowing. This co-location of wind and wave resources increases the overall efficiency of renewable production, creating a more reliable generation system.”

There are many new ways that non-accredited investors can take part in fighting climate change, from investing in startups and renewable energy projects (via crowdfunding) to new banking and investment options.

This week, Zach Stein, one of the Co-Founders of Carbon Collective, talks about how he is envisioning the future of ESG investing.

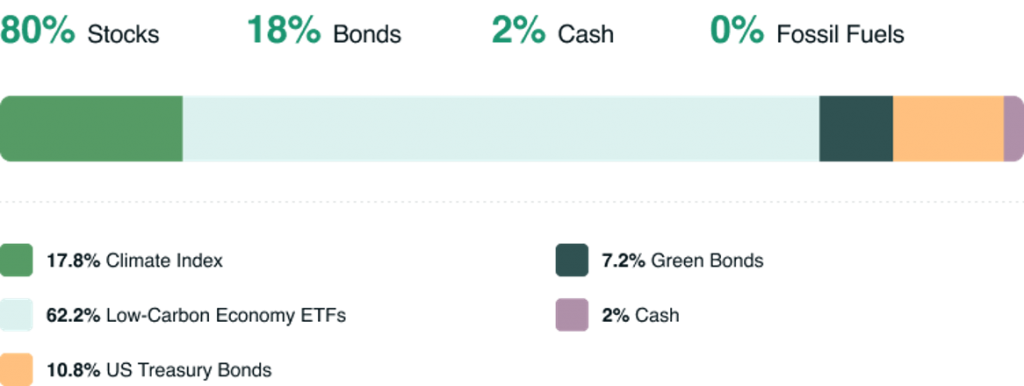

Carbon Collective is a new investment platform that allows you to invest in low-fee, diversified portfolios that are 100% aligned on solving climate change. Right now, what we want to do is help you divest from the companies that are making climate change worse and use that to invest in the companies that are building solutions to climate change. Customers still get the diversity that they want when they are looking to invest in IRA, or something similar. In the long run, we want to be able to use our collective shares to push the parts of the economy that don’t depend on fossil fuels to fully divest from them themselves and to go fully carbon neutral.

We can’t really quantify our impact (yet), but we focus on going beyond ethical investing.

Those of us who are saving for retirement have a unique power in that you can hold a share for 30 years. So, the more shares that long-term investors hold, the more shares that we are removing from circulation. As a result, when companies have good news, it can help them do even better (due to higher demand). For instance, Plug Power was able to sell shares because of high investor demand.

In the long term, we aim to engage companies at the shareholder resolution level. Going green is not only going to help their bottom line, but also help them in their branding, as well as setting aggressive targets and establishing enforcement measures to achieve these goals.

It’s common that ESG funds to screen out companies, resulting in fewer bad companies rather than including companies that are building solutions to climate change. Some of the biggest ESG funds in the world don’t have any renewable energy companies in them. For instance, Betterment’s Climate Impact portfolio is using an ESG framework, but 5% of the portfolio are fossil fuel companies. Another one is ETHO, which is probably my favorite of what’s out there. They are looking at which companies in a given sector are in the lowest quartile for carbon emissions. However, Etho has few companies that are building climate solutions. It’s also a mid-cap heavy fund. For many investment advisors, holding ETHO alone would be pretty far from a balanced portfolio as you’d probably want to balance it with more large-cap investments.

At Carbon Collective, we want to make sure that we set a clear framework. We use scope 1 and 2 emissions to build portfolios with 7x lower carbon emissions than the S&P 500. We believe in making our portfolios truly climate focused and aligned. We fully remove all sectors that depend upon fossil fuels, and we give that allocation to the companies that are building climate solutions. So, we are significantly overweighting the companies that are building solutions to climate change.

Over the next 10 years, we’re going to see a shift from ESG investing to impact investing.

Carbon Collective creates impact with shared capital, but the only way to do that is to make good investments, meaning that we have to remove every reason to say “no” to ethical investing around climate change. Historically these have been:

Carbon Collective’s goal is to expand, drive as much impact as possible, and push the companies that have the most brand risk to decarbonize faster, bringing the rest of the economy with them.

Writers: Swarnav S Pujari, Daniel Kriozere

If you aren’t absolutely thrilled with The Impact, reply and let us know why. Or you can unsubscribe from all updates by clicking here.

Copyright © The Impact 2021. All Rights Reserved || 19 Morris Ave, Bldg 128, Brooklyn NY 11205

Develop your market map of up-and-coming climate startups and market opportunities by subscribing to our weekly newsletter for free.