It is astronomical how much energy is devoted to industrial and transportation services, just take a look at this visual from Saul Griffith’s Otherlab to start to wrap your head around the allocation. It is pretty clear that the world is shifting away from these industries’ primary resources—petroleum, natural gas, and coal— and toward something that can both pack the power needed for heavy industry and capture the emission advantages of wind and solar.

This is where hydrogen comes into play, and Origen Hydrogen is on the way to commercializing an electrolyzer box that uses absolutely no rare earth materials, is fully autonomous, can be turned on and off, and can operate at an impressively small nameplate capacity. The CEO and Founder or Origen, Taylor Huff, talked with me about how Origen’s electrolyzer differentiates from the standard proton exchange membrane (PEM) electrolyzers, how the industry can reach sub $1.50 per kilo H2, the limitations to reaching for 100MW green hydrogen projects, and the best policy and finance environments to help the green hydrogen economy.

Why is solid state an innovation in the electrolyzer space? Is it the same principle as a solid-state battery?

It is the same concept, meaning that the conducting of something, which typically happens in a liquid electrolyte, happens in a solid material. Alkaline electrolyzers would be the conventional, liquid electrolyte technology.

It is quite mature, it has really been around for about a century— the principle of sticking electrodes in an electrolyte fluid and bubbling current. But it is a mature technology that has reached its runway. It has reached 20 gigawatts of alkaline electrolyzers in the chloralkali industry, to produce chlorine gas. So it is a mature technology deployed at scale. There is not a ton of innovation on the technology side or scale up cost reductions, the core electrolyzer is very mature. Liquid electrolytes introduce a more complex balance of plants.

So for an alkaline system, it’s a very complex balance of plants because that liquid electrolyte fluid needs to be separated from the product streams, stored, and recirculated. That complex balance plant has higher capital and operating costs because there’s more pieces of equipment to build and maintain, it is not an autonomous system, it is difficult to scale down in order to site at a fueling station for example, and the system is not easily turned on/ off or ramped up and down. There is a limit to how low you can run the plant, these alkaline systems are like a small chemical plant with this liquid electrolyte fluid and the separate equipment wants to be at certain flow rates and temperatures to operate properly, it wants to be turned on and it wants to stay on.

On the other hand, a solid-state system uses water only and the electrolyte conduction is all done through the solid material. Proton Exchange Membrane electrolyzers (PEMs) would be a solid state, the membrane is the electrolyte. Solid oxide fuel cells are solid state as well, but they have some additional system challenges. Origen’s electrolyzers are solid state and our surrounding system is the same as PEMs. Our system looks like a PEMs system but it is a different box that can be operated autonomously, with a smaller footprint, lower capital costs, can be turned on and off, and can operate at very small nameplate capacity. So, you can really pair [our electrolyzers] with renewables, and you can cite it at a fueling station. It has all the advantages of a PEMs system, but our box eliminates all the expensive metal usage of PEMs. The PEM box is a major capex component because it uses expensive metals for the components and catalysts.

So, are you able to avoid the use of Platinum and Iridium entirely?

We avoid them entirely.

I think this point is not communicated enough. With PEM electrolyzers, it is not just the catalysts, it is the full box, the whole thing is full of exotic metal.

The components are solid titanium coated with gold, and that is to be corrosion resistant in a very acidic environment, plus the voltage. And the catalysts are, as you mentioned, platinum and iridium. So there is the scarcity of metals concern, but more importantly, if you scale up a technology like this your raw materials costs do not decrease, right? Raw materials are such a large portion of costs that it is a cost floor that we believe is an impediment to ever reaching sub $1.50 cent per kilo hydrogen.

At the end of the day, these PEM systems are a box of exotic metals, and for something at an industrial scale this is unheard of.

Does this mean that for hydrogen to be truly cost competitive, no matter how much capital is thrown at it, we may never get hydrogen down to a price that will truly compete with diesel or natural gas without addressing this cost of raw materials issue?

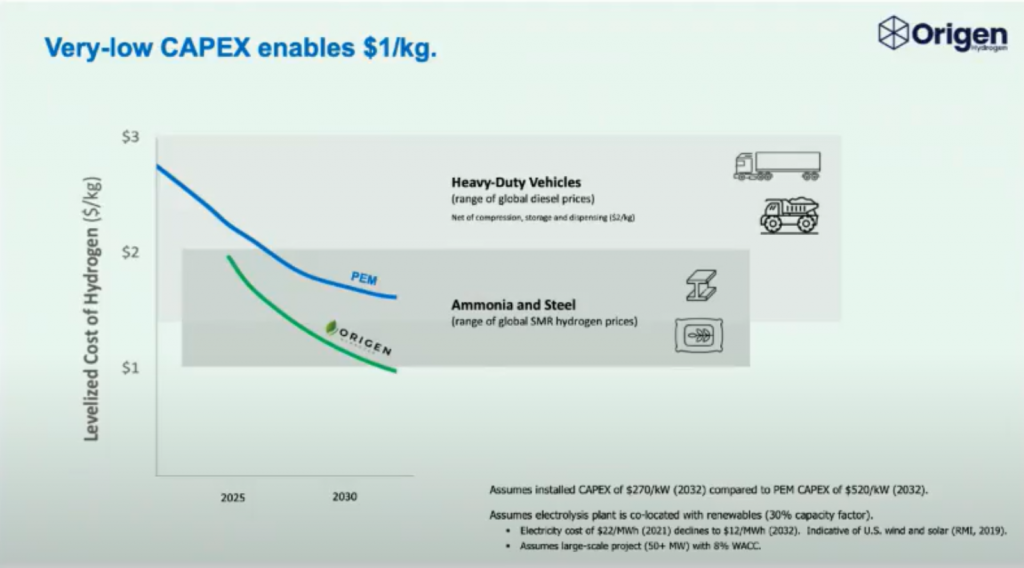

We do not believe that existing technology can reach the price point to open up all these different markets. For some markets, this is sufficient. When competing against diesel, higher cost hydrogen per kilo is acceptable. But the large feedstock markets— steel, fertilizer, methanol chemicals, etc— we think will not reach price parity with PEMS.

Would a carbon tax help change this market environment at all?

A carbon tax definitely helps, but even in a world with a carbon tax there is still an advantage to produce even lower cost hydrogen. It is a competitive advantage for the producer. There is always the impetus to want to decrease your input costs.

Here is the levelized cost of hydrogen. Based on two cost curves, one is a CAPEX cost curve for PEMs based on what ITM Power, NEL, and others have said that they can get to. The other cost curve is renewables becoming cheaper, and there is a Rocky Mountain Institute cost curve for US wind and solar. We see PEMs leveling out at around $1.60 to $1.70 per kilo. But that is only production cost, so then if you need to transport and store the hydrogen then that adds to the cost. This will not be sufficient for the larger feedstock markets. But if you take the precious metals out, the wedge, which is the ~60-70 cents per kilogram delta between PEMs and Origen Hydrogen, is very important for these feedstock markets. It is quite a competitive advantage for a steel or fertilizer plant to have that much cheaper hydrogen.

Is there any additional details you can share on the materials used in the components of your systems? If they are not using rare earth metals, what are they using?

In our box, we use an Anion Exchange Membrane, not a Proton Exchange Membrane (PEM). A PEM connects the protons, but here we conduct the anions (OH-). What this means is that we do not have acidic conditions. A membrane that connects protons like a PEM is highly, highly, acidic. It is really kind of the definition of acidity, just a whole bunch of protons moving through. So, everything in contact with that membrane in the surrounding area is exposed to these very acidic conditions. This is why we need [these expensive metals]. But in Anion exchange membranes, since we are not conducting protons, we do not have those acidic conditions.

Thus, our catalysts are nickel and iron based, and our components are one of the grades of stainless steel. So the types of stuff we see at industrial scale, like stainless steel reactors, nickel and iron catalysts.

It seems like the period of time from research bench to commercialization is becoming shorter and shorter for materials science. One reason for this is the application of machine learning approaches to materials discovery and development. Did you use any machine learning techniques in your discovery process? Will you need to continue to innovate in the materials you use in order to maintain your cost of hydrogen advantage over PEMs?

That is an interesting question. The initial R&D [for Origen Hydrogen started] at Georgia Tech more than 10 years ago in 2009. We think the materials [we use in our electrolyzers] are fully developed, there has been 1000s of hours of testing. So we feel confident in the materials. I am not aware of any AI based techniques they used. We are using some machine learning techniques when we test the entire assembly. This helps speed things up first, but this is not a core expertise.

What about more generally on how the trend of applying machine learning to materials science to reduce the time to commercialization? Should the hydrogen market be paying attention to this?

It definitely helps accelerate things, but it does not necessarily just have to be about developing novel materials. I view the material as the platform and the ink and the electrode design is where the continuing incremental innovation can be. And there are analogies to that on the battery side as well with companies going after new electrode designs, Sila Nanotech, is probably the most well-funded one that has a new targeted electrode for the platform. But I think in our case the application is more on electrodes and catalyst ink, which is materials science, but it lends itself toward quicker iterations and discoveries.

Is the lack of a liquid electrolyte a manufacturing advantage? To an extent, the name of the game in new technology is getting to higher and higher manufacturing capacities to reduce costs and ideally take advantage of scaling laws. Does the solid-state nature of the electrolyzers make scaled manufacturing more accessible than would be the case with an electrolyzer market that uses liquid electrolytes?

I wouldn’t necessarily phrase it that way. For us specifically, the fact that we use the same balance of plant as a PEM, that is really an accelerator to scale. So we only need to develop the box. And then there is an ecosystem of partners to work with on the balance plant. So less resources to commercialize, easier to get to scale manufacturing the box rather than the full systems.

This is not one of our main thesis, but I do think that it is worth noting that for electrolyzers, the manufacturing costs are much lower compared to the materials cost than for solar and batteries. And that’s because for solar, silicon is very cheap. So solar is doping semiconductors, and you need these expensive factories and clean rooms, and there is a lot of potential there.

Lithium ion is still relatively cheap, and the entire battery is not built using precious metals in the housing and all of the layers. Whereas with PEMs, there is a cost reduction with manufacturing at scale, but to manufacture them is not that difficult. So it is taking these different layers, assembling and testing them, and then there is really only one coating process. Materials costs are a fairly significant shock. So there is a different way of thinking that states there still needs to be innovation against that materials cost wedge, and you can only go so far with manufacturing scale.

Does anything make you nervous about the strategy Origen Hydrogen is betting on?

What I am concerned about is the speed to market. Not so much the technology locking, but more how do we get to market quickly enough and de-risk and prove the technology such that a company that’s developing very large projects will feel comfortable investing in our technology. And I think that what’s more of a challenge for green hydrogen and some of these other technologies is the scale of projects. If we exclude mobility, the feedstock markets (steel, ammonia, methanol usage and refining, etc) are all very large demand centers.

So there is not a huge hydrogen market in the 10 to 15 Megawatt range. There will be smaller scale industrial uses in the fueling station market, in the 5 to 10 MW range. But then the other demand will be 100 megawatt plus, so how do we get the technology proven and bankable to be deployed in the 100 MW plus projects. I think it is really speed, deployments, and operating hours.

If you were responsible for creating the right policy and finance environment to enable the hydrogen economy, what principles do you think would act as the foundation for this new environment? What do you want to see as a founder from the policy and financial leaders?

I hate to use the word subsidy, but the investment tax credit for solar is a capital cost subsidy.

That will definitely drive the market growth for green hydrogen. If projects are eligible, meaning confirmed renewable energies input to find use for the green hydrogen, the ability for some of that CAPEX to be returned in the form of tax credit. That definitely helps.

In Europe that is a model that is being used to accelerate deployment. They actually call it a CAPEX subsidy and projects on a case-by-case basis submit for capex sharing. I think that in the US that should be framed as an investment tax credit. This would certainly help.

On the other side of things, you can call it a price premium for the product, a low carbon fuel standard beyond California, Oregon, and Washington deployed federally could help from a couple of different angles. It would help build out a fueling station network. Hydrogen stations in California are eligible for LCFS credits.

It also incentivizes any existing renewable fuels to use green hydrogen, like renewable diesel and jet fuel. There is a large build out going on and refinery conversions to produce these products. If you use green hydrogen and the refining of renewable diesel or jet fuel, that is a further price premium for the product that definitely incentivizes a switch to green hydrogen. So I would say those two mechanisms would be the most effective. Probably the investment tax credit is the simplest mechanism.

Thoughts and Outlook

Michael Liebreich, founder of Bloomberg New Energy Finance and host of the clean energy podcast Cleaning Up, has repeatedly mentioned the versatility of hydrogen in a decarbonized energy future. But when it comes to the options for heavy industry, and how they may be able to take advantage of the cheap energy enabled by wind and solar, their options may be more limited.

Not even the best policy environments can overcome the reality of physics and unit economics. Cheaper materials to produce more efficient and affordable electrolyzers will enable low cost production of green hydrogen, but some rather steep market milestones still need to be met. Getting electrolyzers to a scale that enables sub $1.50 / kilo of hydrogen is a major milestone that will enable incredible decarbonization across the board. Companies like Origen Hydrogen are helping heavy industry decarbonize, but saliency might be an overlooked feature that must be addressed alongside the physical challenges of commercializing a technology. Many fronts will need to be attacked at once, and Origen is making sure that when the market is ready they have the hardware to enable a green hydrogen economy.

About The Author

Max is a Business Analyst at Cleantech Ventures, LLC, an international consulting agency assisting early-stage cleantech startups. He is an aspiring managing director of an early-stage clean energy accelerator.