Howdy 👋

This week is packed. My favorite piece this week is all about a company working on getting hydrogen to sub $1.50 and that makes me excited, as it should you 🙃.

Ah – if you find value from this newsletter on a weekly basis, we’d all appreciate it if you shared a link for people to subscribe to The Impact (psst. it’s here).

Every 100 new subscribers we add we’ll pick someone at random who shared The Impact on LinkedIn or Twitter to highlight as part of these amazing commentary paragraphs I grace your screen with.

All you have to do is tag The Impact!

– Swarnav S Pujari

In Your Inbox: A startup aiming to drive hydrogen below $1.50/kg; Repurposing oil wells for energy storage and generation; A new startup aiming to rebuild the grid differently; Clean energy and Congress

It is astronomical how much energy is devoted to industrial and transportation services, just take a look at this visual from Saul Griffith’s Otherlab to start to wrap your head around the allocation. It is pretty clear that the world is shifting away from these industries’ primary resources—petroleum, natural gas, and coal— and toward something that can both pack the power needed for heavy industry and capture the emission advantages of wind and solar.

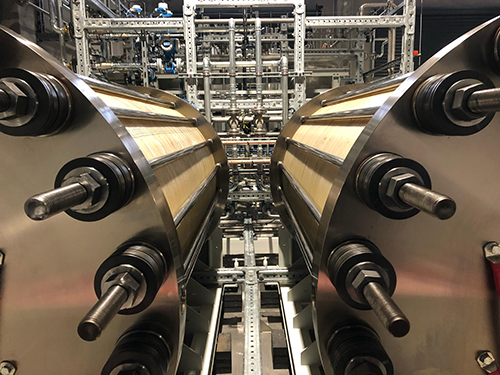

This is where hydrogen comes into play, and Origen Hydrogen is on the way to commercializing an electrolyzer box that uses absolutely no rare earth materials, is fully autonomous, can be turned on and off, and can operate at an impressively small nameplate capacity. The CEO and Founder of Origen, Taylor Huff, talked with me about how Origen’s electrolyzer differentiates from the standard proton exchange membrane (PEM) electrolyzers, how the industry can reach sub $1.50 per kilo H2, the limitations to reaching for 100MW green hydrogen projects, and the best policy and finance environments to help the green hydrogen economy.

It is the same concept, meaning that the conducting of something, which typically happens in a liquid electrolyte, happens in a solid material. Alkaline electrolyzers would be the conventional, liquid electrolyte technology.

It is quite mature, it has been around for about a century— the principle of sticking electrodes in an electrolyte fluid and bubbling current. But it is a mature technology that has reached its runway. It has reached 20 gigawatts of alkaline electrolyzers in the chloralkali industry, to produce chlorine gas. So it is a mature technology deployed at scale. There is not a ton of innovation on the technology side or scale-up cost reductions, the core electrolyzer is very mature. Liquid electrolytes introduce a more complex balance of plants.

So for an alkaline system, it’s a very complex balance of plants because that liquid electrolyte fluid needs to be separated from the product streams, stored, and recirculated. That complex balance plant has higher capital and operating costs because there are more pieces of equipment to build and maintain, it is not an autonomous system, it is difficult to scale down to the site at a fueling station for example, and the system is not easily turned on/ off or ramped up and down. There is a limit to how low you can run the plant, these alkaline systems are like a small chemical plant with this liquid electrolyte fluid and the separate equipment wants to be at certain flow rates and temperatures to operate properly, it wants to be turned on and it wants to stay on.

On the other hand, a solid-state system uses water only and the electrolyte conduction is all done through the solid material. Proton Exchange Membrane electrolyzers (PEMs) would be in a solid-state – the membrane is the electrolyte. Solid oxide fuel cells are solid-state as well, but they have some additional system challenges. Origen’s electrolyzers are solid-state and our surrounding system is the same as PEMs. Our system looks like a PEMs system but it is a different box that can be operated autonomously, with a smaller footprint, lower capital costs, can be turned on and off, and can operate at a very small nameplate capacity. So, you can pair [our electrolyzers] with renewables, and you can cite it at a fueling station. It has all the advantages of a PEMs system, but our box eliminates all the expensive metal usage of PEMs. The PEM box is a major CAPEX component because it uses expensive metals for the components and catalysts.

We avoid them entirely.

I think this point is not communicated enough. With PEM electrolyzers, it is not just the catalysts, it is the full box, the whole thing is full of exotic metal.

The components are solid titanium coated with gold, and that is to be corrosion resistant in a very acidic environment, plus the voltage. And the catalysts are, as you mentioned, platinum and iridium. So there is the scarcity of metals concern, but more importantly, if you scale up a technology like this your raw materials costs do not decrease, right? Raw materials are such a large portion of costs that it is a cost floor that we believe is an impediment to ever reaching sub $1.50 per kilo hydrogen.

At the end of the day, these PEM systems are a box of exotic metals, and for something at an industrial scale – this is unheard of.

We do not believe that existing technology can reach the price point to open up all these different markets. For some markets, this is sufficient. When competing against diesel, higher-cost hydrogen per kilo is acceptable. But the large feedstock markets— steel, fertilizer, methanol chemicals, etc— we think will not reach price parity with PEMS.

A carbon tax helps, but even in a world with a carbon tax, there is still an advantage to produce even lower-cost hydrogen. It is a competitive advantage for the producer. There is always the impetus to want to decrease your input costs.

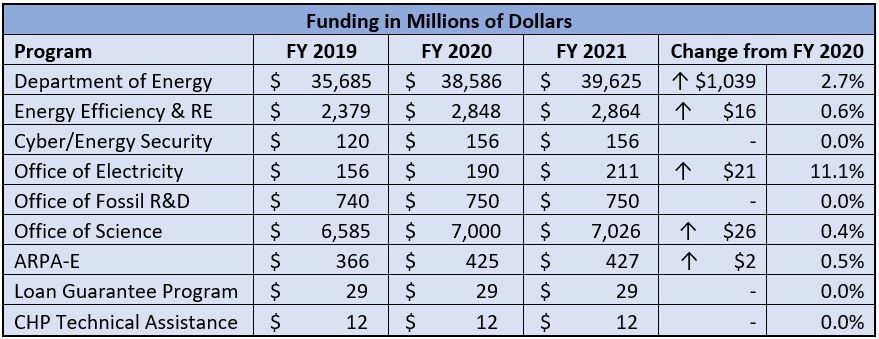

Here is the Levelized cost of hydrogen. Based on two cost curves, one is a CAPEX cost curve for PEMs based on what ITM Power, NEL, and others have said that they can get to. The other cost curve is renewables becoming cheaper, and there is a Rocky Mountain Institute cost curve for US wind and solar. We see PEMs leveling out at around $1.60 to $1.70 per kilo. But that is only production cost, so then if you need to transport and store the hydrogen that adds to the cost. This will not be sufficient for the larger feedstock markets. But if you take the precious metals out, the wedge, which is the ~60-70 cents per kilogram delta between PEMs and Origen Hydrogen, is very important for these feedstock markets. It is quite a competitive advantage for a steel or fertilizer plant to have that much cheaper hydrogen.

In our box, we use an Anion Exchange Membrane, not a Proton Exchange Membrane (PEM). A PEM connects the protons, but here we conduct the anions (OH-). What this means is that we do not have acidic conditions. A membrane that connects protons like a PEM is highly acidic. It is kind of the definition of acidity, just a whole bunch of protons moving through. So, everything in contact with that membrane in the surrounding area is exposed to these very acidic conditions. This is why we need [these expensive metals]. But in Anion exchange membranes, since we are not conducting protons, we do not have those acidic conditions.

Thus, our catalysts are nickel and iron-based, and our components are one of the grades of stainless steel. So the types of stuff we see at an industrial scale, like stainless steel reactors, nickel, and iron catalysts.

That is an interesting question. The initial R&D [for Origen Hydrogen started] at Georgia Tech more than 10 years ago in 2009. We think the materials [we use in our electrolyzers] are fully developed, there have been 1000s of hours of testing. So we feel confident in the materials. I am not aware of any AI-based techniques they used. We are using some machine learning techniques when we test the entire assembly. This helps speed things up first, but this is not our core expertise.

It helps accelerate things, but it does not necessarily just have to be about developing novel materials. I view the material as the platform and the ink and the electrode design is where the continuing incremental innovation can be. And there are analogies to that on the battery side as well with companies going after new electrode designs, Sila Nanotech, is probably the most well-funded one that has a new targeted electrode for the platform. But I think in our case the application is more on electrodes and catalyst ink, which is a materials science, but it lends itself toward quicker iterations and discoveries.

I wouldn’t necessarily phrase it that way. For us specifically, the fact that we use the same balance of plant as a PEM is an accelerator to scale. So we only need to develop the box. And then there is an ecosystem of partners to work with on the balance plant. So fewer resources to commercialize, easier to get to scale manufacturing the box rather than the full systems.

This is not one of our main thesis, but I do think that it is worth noting that for electrolyzers, the manufacturing costs are much lower compared to the materials cost than for solar and batteries. And that’s because for solar, silicon is very cheap. So solar is doping semiconductors, and you need these expensive factories and clean rooms, and there is a lot of potential there.

Lithium-ion is still relatively cheap, and the entire battery is not built using precious metals in the housing and all of the layers. Whereas with PEMs, there is a cost reduction with manufacturing at scale, but to manufacture them is not that difficult. So it is taking these different layers, assembling and testing them, and then there is only one coating process. Materials costs are a fairly significant shock. So there is a different way of thinking that states there still needs to be innovation against that materials cost wedge, and you can only go so far with manufacturing scale.

What I am concerned about is the speed to market. Not so much the technology locking, but more how do we get to market quickly enough and de-risk and prove the technology such that a company that’s developing very large projects will feel comfortable investing in our technology. And I think that what’s more of a challenge for green hydrogen and some of these other technologies is the scale of projects. If we exclude mobility, the feedstock markets (steel, ammonia, methanol usage, and refining, etc) are all very large demand centers.

So there is not a huge hydrogen market in the 10 to 15 Megawatt range. There will be smaller-scale industrial uses in the fueling station market, in the 5 to 10 MW range. But then the other demand will be 100-megawatt plus, so how do we get the technology proven and bankable to be deployed in the 100 MW plus projects. I think it is speed, deployments, and operating hours.

I hate to use the word subsidy, but the investment tax credit for solar is a capital cost subsidy.

That will drive the market growth for green hydrogen. If projects are eligible, meaning confirmed renewable energies input to find a use for the green hydrogen, the ability for some of that CAPEX to be returned in the form of a tax credit. That definitely helps.

In Europe that is a model that is being used to accelerate deployment. They call it a CAPEX subsidy and projects on a case-by-case basis submit for CAPEX sharing. I think that in the US that should be framed as an investment tax credit. This would certainly help.

On the other side of things, you can call it a price premium for the product, a low carbon fuel standard beyond California, Oregon, and Washington deployed federally could help from a couple of different angles. It would help build out a fueling station network. Hydrogen stations in California are eligible for LCFS credits.

It also incentivizes any existing renewable fuels to use green hydrogen, like renewable diesel and jet fuel. There is a large build-out going on and refinery conversions to produce these products. If you use green hydrogen and the refining of renewable diesel or jet fuel, that is a further price premium for the product that incentivizes a switch to green hydrogen. So I would say those two mechanisms would be the most effective. Probably the investment tax credit is the simplest mechanism.

Michael Liebreich, founder of Bloomberg New Energy Finance and host of the clean energy podcast Cleaning Up, has repeatedly mentioned the versatility of hydrogen in a decarbonized energy future. But when it comes to the options for heavy industry, and how they may be able to take advantage of the cheap energy enabled by wind and solar, their options may be more limited.

Not even the best policy environments can overcome the reality of physics and unit economics. Cheaper materials to produce more efficient and affordable electrolyzers will enable low-cost production of green hydrogen, but some rather steep market milestones still need to be met. Getting electrolyzers to a scale that enables sub $1.50 / kilo of hydrogen is a major milestone that will enable incredible decarbonization across the board. Companies like Origen Hydrogen are helping heavy industry decarbonize, but saliency might be an overlooked feature that must be addressed alongside the physical challenges of commercializing technology. Many fronts will need to be attacked at once, and Origen is making sure that when the market is ready they have the hardware to enable a green hydrogen economy.

Sign up for The Impact and learn the perspectives behind the latest sustainability trends

What to do with all of those oil wells? Use them to produce and store clean energy, of course.

That’s what Kemp Gregory, CEO, and Stefan Streckfus, CTO, of Renewell Energy, are actively working towards.

Renewell Energy’s timing may be opportune as they’re working on a prototype in Texas and it should be ready to test in mid-July as the White House’s pending infrastructure plan includes about $17B to remediate oil wells, which is what Renewell would like to do.

Reusing oil wells certainly seems better than just leaving them be or destroying them. Especially, as reports have shown, up to 40 percent of oil wells pollute methane or carcinogenic chemicals. So, how could Renewell renew the two million or so U.S. oil wells that are currently inactive and remain unplugged as well as all of those that will soon be defunct? Here’s the plan:

Renewell’s forthcoming prototype is intended to show they can charge their energy storage device in these oil wells by lifting a cylindrical weight to the top of an oil well which converts energy to potential energy. An advantage here would be that the mechanical storage of energy could be stored for as long as the weight is suspended.

To produce energy, Renewell’s regenerative winch would lower the weight to the bottom of the oil well so the winch’s motor would move in reverse and would act as a generator to produce electrical energy. Again, one of the benefits of producing energy with the lifting and falling of weight is that this mechanical process could be paused or started at any time.

The team at Renewell is working to finalize a commercial design and to get to full-scale production with pre-seed funding. However, the team acknowledged they will need to overcome regulatory hurdles from organizations such as CalGEM that regulate oil wells as no one up to this point ever considered adapting these wells for clean energy production and storage.

So, incentives in place for these oil wells are set up to ‘pull’ oil instead of storing energy which means once an oil well stops producing oil or gas, it is penalized to prompt the clean-up of the non-operational well. Renewell Energy is working with CalGEM and other regulatory agencies to overcome this penalty that if left in place could negatively affect the financial return on investment, or ROI, of their clean energy and storage solution.

Renewell conveyed their expectations to close a seed round in 2022. I hope their pre-seed funding is renewed so their team can bring well-deserved ‘wellness’ to all defunct and polluting oil wells in the U.S.

In a significant milestone for the development of its microgrid technology, ElectricFish has been issued a patent that uniquely covers the creation of a “utility of the future” that is built of locally decentralized energy storage units and dynamically optimizes energy to enable a seamless and grid-resilient transition to EV charging.

ElectricFish serves a gap in the market where utilities are struggling (with EV charging load). The main value proposition is the ability to manage units together and then use the aggregated capacity effectively. Optimistically, they will solve the challenges of building local energy capacity and serving fast charging inside cities.

Editors: Swarnav S Pujari, Daniel Kriozere Writers: Jeff Macon, Andy Barnes, Max Melnick

If you aren’t absolutely thrilled with The Impact, reply and let us know why. Or you can unsubscribe from all updates by clicking here.

Copyright © The Impact 2021. All Rights Reserved || 19 Morris Ave, Bldg 128, Brooklyn NY 11205

Develop your market map of up-and-coming climate startups and market opportunities by subscribing to our weekly newsletter for free.