🌍 COP26 is about a week away…And our resident Daniel is going to be there getting us the down-low on what discussions, startups and agreements are going to come from this major meetup!

In preparation for that – we have a podcast on reforestation, a deep dive on an awesome early stage climate fund and a market report on hydrogen.

A chock-full of fun.

THE TL;DR 💨

🌳 Bringing Transparency to Reforestation Efforts • Pachama

- Utilizing satellites to verify reforestation projects are bringing transparency to carbon offsets issued from reforestation efforts

- Diego’s personal founder journey and ideas for other emerging founders

- How Pachama is pivotal in its growth

💰 Climate Impact Investing at Pale Blue Dot

- Pale Blue Dot invests in high conviction, extraordinary founders that are creating climate impact

- Teams and trust are key components to Pale Blue Dot’s ultimate investment decision

- Pale Blue Dot will write €500K – 2M checks into pre-seed and seed stage startups with post-money valuations no larger than €12M

🤔 What’s the Deal With Hydrogen?

- Why hydrogen and what’s the difference between each color

- What are the hydrogen’s most promising applications/reading through the hype

- What are their realistic timelines

🚀 STARTUPS & TECH

Bringing Transparency to Reforestation Efforts • Pachama

By Swarnav S Pujari • is the CEO at TouchLight and Appointed Chairman of the Yorktown Climate Smart Communities Task Force.

Planting trees and conserving our forests has been a long known way to mitigate climate change and draw down carbon. With climate activism becoming an ever-growing global movement over the past decade – corporations and governments are actively seeking ways to push capital into organizations to help them decarbonize operations.

But as is with any emerging market there are challenges.

Carbon offsets are a method of financing reforestation projects.

– Diego Saez Gil

It’s necessary to understand this as in the early days of the carbon offsets market major corporations would purchase offsets that never really drew down carbon (either due to issues like double counting or the trees planted not being monitored for the years coming – more on these issues in future podcasts).

Funding for reforestation is abundant but verifying the performance + validity of purchased offsets is slowing this market down

Enter Pachama...

Pachama enables remote verification over the life of reforestation projects by utilizing satellite data mixed with AI to ensure reforestation projects are being maintained and are performing for the life of the project.

Over the past year, they have been a maverick and leader in the carbon offsets space – driving large corporations in as customers and significant funding dollars from large organizations and climate-focused funds.

With their technology continuously improving by the constant support and focus of their data science team, Pachama is on pace to truly bring transparency to the carbon offsets market. This could unlock billions per year in capital for reforestation projects.

Market Need:

The carbon offsets market has a lot of catching up to do for us to truly reach the targets we need to hit to draw down enough carbon before the world heats up beyond repair…

However, providing transparency and confidence to teams/corporations that funnel money into this marketplace changes the game for adoption and more importantly pace of reforestation. Though transparency at scale is necessary for this market to break open, the world requires a recalibration on what carbon offsets are truly used for.

Traditionally we view carbon offsets as a proxy method for corporations to “cheat the system” and not actually provide any tangible progress in decarbonization. This was true before companies like Pachama – which now makes carbon offsets a true funding mechanism for drawing down carbon through reforestation

This reframing suddenly opens up an ocean of opportunity for startups or groups like Pachama to serve. Everything from new climate asset types/classes to improved transaction transparency are on the table when we view carbon offsets as a version one climate asset class.

Future Outlook:

Funding and customer traction are the least of Pachama’s concerns – as is with any great company. We expect to see high-end talent funneling into Pachama – which should result in new products and product lines providing ways to funnel more money into climate-positive assets. As demonstrated by the launch of their API.

This is the start of a new market after what I call the “Pachama Recalibration of Funding Carbon Sequestration” and I’m hopeful that we’ll see a significant emergence of startups led by top founders. The key thing to keep an eye on isn’t only carbon drawdown technologies – but the companies that are exploring ways to funnel capital at a large scale into the breadth of projects powered by a breadth of technologies.

Asset classes and funding models for carbon drawdown. That may be the biggest opportunity of them all.

💸 VC DEEP DIVE

Climate Impact Investing at Pale Blue Dot

By Daniel Kriozere • is a Principal at C3, Tech Scout at For ClimateTech, and Venture Scout at Prithvi - and has an extensive network within the broader climate investment and startup community.

Pale Blue Dot is an €87M pre-seed and seed stage ClimateTech fund investing in startups that reduce and reverse the effects of climate change and prepare for a new world. They are trying to fill the gap of providing funding for startups that need between €500K-3M. Pale Blue Dot invests in high conviction, extraordinary founders that are creating climate impact.

Fund Snapshot

- Stage: Pre-Seed – Seed

- Check Size: €500K – 2M

- Geography: Europe, US

- Lead/Follow: Lead or Co-Lead

- Revenue/Valuation Thresholds: Maximum post-money valuation of €12M, preferred

About the Fund

Why was the fund started?

Pale Blue Dot was founded in 2020 by Heidi Lindvall, Hampus Jakobsson, and Joel Larsson focusing on addressing the climate breakdown. The team itself seeks to combine their entrepreneurial and investor past with hard sciences, storytelling, and humanitarian aid backgrounds to drive climate innovation at scale.

What is Pale Blue Dot’s core belief?

Trust is a key component to Pale Blue Dot’s ultimate investment decision, meaning that Pale Blue Dot puts founders first. They are all about having conversations with founders to understand their why and their thoughts on the problem they are solving. Trusting a founder means trusting that the founder can build a team and stay on track to build a 100% climate impact startup.

What domains in climate tech does Pale Blue Dot have the greatest expertise in?

Pale Blue Dot is a generalist climate fund. However, they like to approach sectors after doing their own research, meaning they know what kind of startup they would like to invest in. They have invested in many different verticals to date, from mobility to food/agriculture.

What type of portfolio support does the team provide?

Pale Blue Dot is a small team that truly cares about the founder first. Pale Blue Dot will prioritize the founder over the startup. If you make a founder great, the founder will be able to lead a great startup.

One of the three GPs is the startup’s coach, each startup syncs up with their GP on a biweekly basis and the founder can reach the GP day or night.

As Pale Blue Dot is focused on the people aspect, they can help with:

- Culture

- HR

- Hiring

- Process

- Mental Health

About the Fund

What is Pale Blue Dot’s investment process and timeline?

Pale Blue Dot’s investment decision can take as little time as 1 week, and as long as 3 months – it depends on the founder’s timeline. However, Pale Blue Dot’s process was made to create friction, in the sense of having quality conversations and getting to know a founder.

As mentioned previously, Pale Blue Dot does their own research on topics of interest before connecting with a startup. One of the three GPs will be on the first call with a startup – the GP that is on that first call is the lead. After that first call, the lead needs to love the startup in order to proceed. At that point, one of the other GPs will play devil’s advocate in order to think through the business.

There are standardized questions that Pale Blue Dot talks through – the conversation and the resulting questions is the important part. The questions indicate if Pale Blue Dot has a lack of info or a lack of faith. Regardless, all of these questions are shared with the founder.

When Pale Blue Dot is ready, the GPs vote on a deal. There needs to be at least one “Hell Yes” and one “Yes” for the team to proceed to an investment/term sheet.

What would make Pale Blue Dot consider deviating from their typical criteria?

At the end of the day, Pale Blue Dot cares more about the people behind a startup more than anything else. They want to invest in extraordinary people, even if the idea won’t be as high as an environmental impact return as they would traditionally invest in.

Sign up for The Impact and learn the perspectives behind the latest sustainability trends

🚀 STARTUPS & TECH

What’s the Deal with Hydrogen?

By Ryan Jones • is a Senior ClimateTech Associate at SecondMuse and Climate Journalist

In the all-encompassing quest to steer humanity’s future towards carbon neutrality, some challenges are easier to solve than others. We hold our breath in anticipation for the innovations of tomorrow to sweep away today’s problems. As the global discussion and news cycle steers towards the success and the simplified, we hear of the incredible cost curves of solar and battery technologies, press releases promising carbon-neutral corporations, and incredible innovations inching their way out of the lab. In the context of an existential, all-encompassing crisis, our moth-like brains are drawn to hope like a candle. But the challenges that require less sexy and more patient, nuanced, and complicated solutions, are still unsolved.

These challenges include some of the most prevalent human creations including cement, steel, fertilizer, aviation, shipping, long-term storage, and chemical feedstock. Hydrogen has the potential to prove imperative in decarbonizing these industries, and governments have caught on. The UK just released its hydrogen strategy, the US included building four new regional clean hydrogen hubs in their new infrastructure bill, the EU was the first with its hydrogen policy and China has included hydrogen in the latest 5-year plan as one of its six industries of the future. Even NY just committed to testing green hydrogen mixed in with natural gas in a new utility-scale power plant. Why hydrogen, what’s the difference between each color, what are the hydrogen’s most promising applications, and what are their realistic timelines?

Why Hydrogen and what color is it?

What makes hydrogen unique is the science isn’t new and, depending on the application, is proven to work. More than 90m tonnes are produced each year, resulting in revenues of over $150bn.

The majority of that production comes from producing ammonia, a foundational ingredient in artificial fertilizer. But depending on how it’s made, the costs, infrastructure and government incentives hold it back from widespread adoption. In comparison with natural gas, hydrogen contains nearly three times the amount of energy per unit and its by-product is simply water. Despite being the lightest and most abundant element in the universe, we first have to make it. The three main methods of doing so are; creating hydrogen from fossil fuels (grey), creating hydrogen from fossil fuels but using carbon capture to capture emissions (blue), or by using electricity to split the H from the 2O in water using electrolyzers (green).

Blue/Grey Hydrogen

- What; The process of steam methane reforming (SMR), Blue hydrogen is produced from natural gas, with carbon capture and storage (CCS) technology scooping up the resulting CO2.

- Case for; Many say moving to blue hydrogen first is unavoidable and more realistic as a transition to begin reducing emissions now, since with a carbon-neutral source of energy and CCS attached, blue hydrogen produces fewer emissions than natural gas. Another concern is that green hydrogen can’t be cost-competitive or adopted at a wider scale in the current market and we need GHG reductions now.

- Case against; Blue hydrogen locks in dependence on natural gas, which includes all the price volatility and geopolitics that comes with it, while assuming the development of cheap and effective CCS. But in its current state CCS has not widely reached the required efficiency levels. Currently, 60 to 70 percent efficiency is more common than the 95 percent that would be required to be truly net-zero, with its production currently emitting 830m tonnes of CO2 each year.

Green Hydrogen

- What; Green hydrogen, in contrast, is created using renewable energy to power an electrolyzer that splits the hydrogen from water molecules. There are three kinds of electrolysis; PEM (Polymer Electrolyte Membrane), Alkaline (AEL); and Solid oxide. PEM uses precious metals and is generally more expensive. Alkaline electrolysis does not use any expensive and precious metals but is limited to very low current densities which results in costly and bulky systems.

- Case for; Most everyone agrees full-scale adoption of green hydrogen is where we want to get to and is the only true carbon-neutral option, it’s just about when and how.

- Case against; Green hydrogen, however, requires cheaper electricity than is currently available as well as an end market for hydrogen that can sustain high electrolyzer utilization rates so that it can stay competitive. Production and manufacturing of electrolyzer is another barrier. Currently, Gigafactory-scale electrolyzers are being built across Europe but scale and infrastructure are needed in the US to decrease those costs.

Other colors include pink, electrolyzers powered by nuclear, and turquoise where pyrolysis is utilized in heating methane until the hydrogen splits.

While traditional electrolyzers are getting cheaper, they aren’t the only method of creating hydrogen. Over the last few years, there’s been an explosion of startups looking at utilizing different waste streams including everything from industrial waste to biological feedstock. Alex Lewis, CEO of ElectroActive, a startup utilizing food waste to create hydrogen emphasizes how different means of production can benefit from different contexts; “Waste in urban settings has certain benefits over electrolysis with enormous food waste streams in bigger cities, building the process further into everyday life”. Alex goes on to explore the further benefits, “Utilizing current waste streams opens the door for us to have a negative carbon lifecycle, displacing the emissions from food waste going to landfills and the same thing is happening with medical waste or plastic waste”. Alex goes on to emphasize how the best strategy though is one that includes all of the above and the growing narrative framing the decision as a choice between batteries or hydrogen is detrimental to everyone. Like battery technology, certain tech makes sense in certain contexts and applications.

How we read each of these options is really a reflection of how you see the climate crisis will be solved. Each side has its own biases, interests, and assumptions baked into its opinion. Whether it be invested interest in natural gas and a pragmatic belief in market mechanisms for blue hydrogen or skepticism towards the practicality of CCS and more urgency in reducing GHG with green hydrogen. Hydrogen specialist, Ahsan Syed explains the importance of understanding the dynamics of both; “What’s most dangerous is anyone saying they’re right while not truly understanding and knowing the nuances of each solution. Each side is not only competing with each other about the right approach to long-term decarbonization, but with the broader energy industry and other proposed climate solutions for investment, political support, and public attention”. Sensationalizing our innovations has become a mainstay but understanding their applications and timelines are critical to keeping our feet on the ground.

Timelines

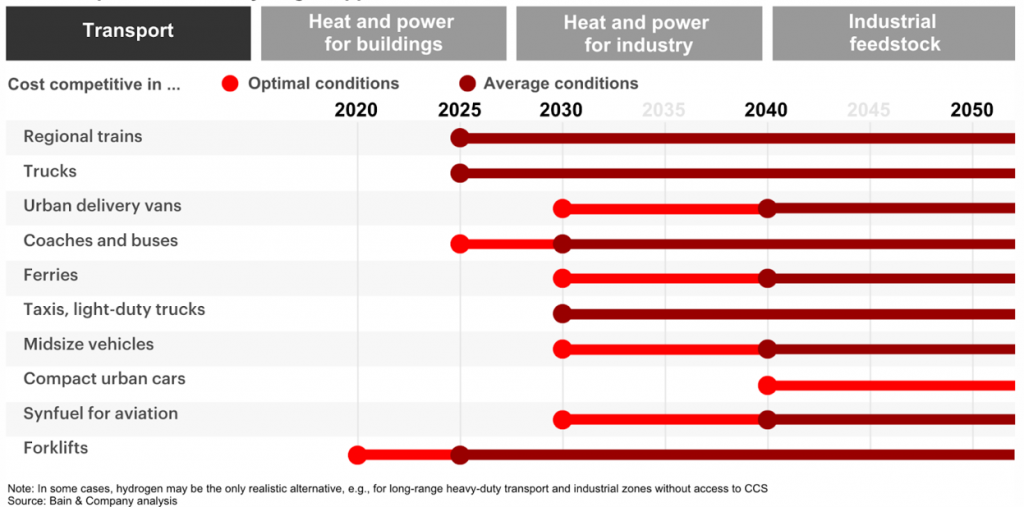

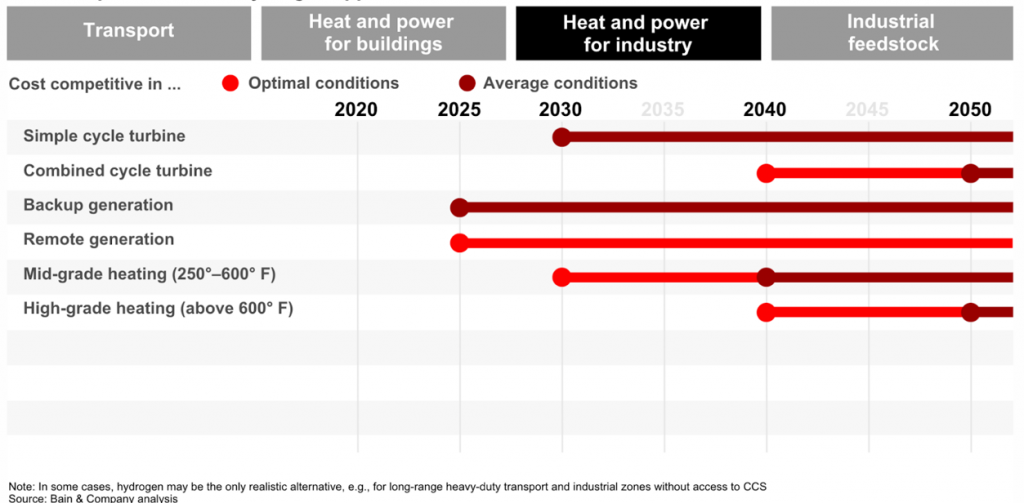

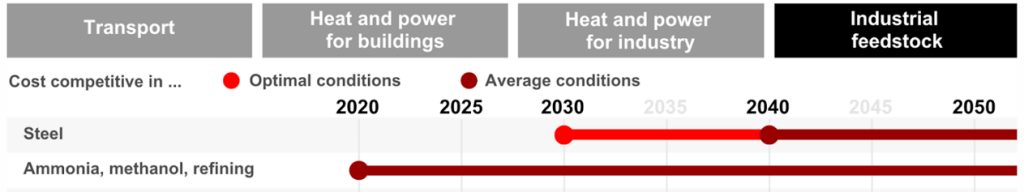

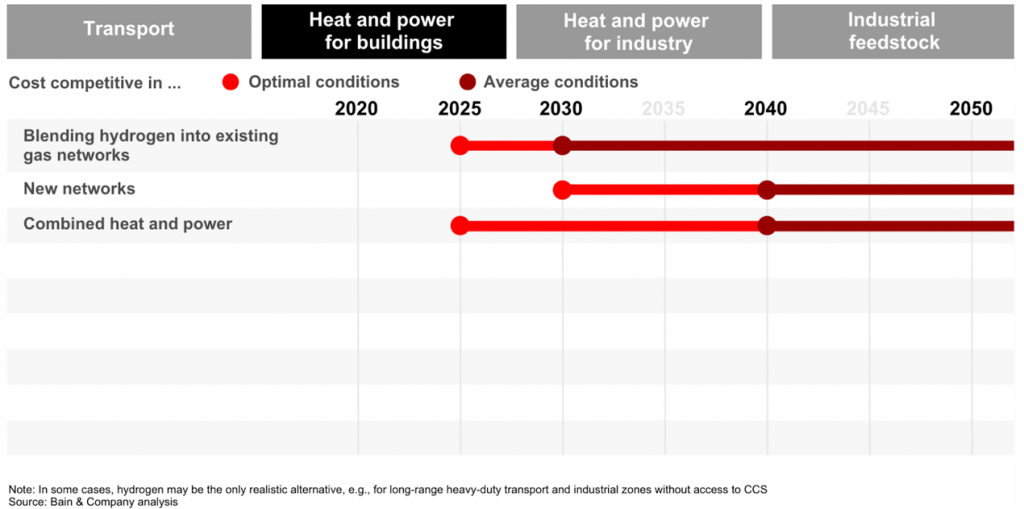

Hydrogen has numerous promising applications towards some of our most challenging problems. Below is a timeline across industries from a great report on the cost competitiveness of hydrogen from Bain, identifying when a few of the most promising applications will be competitive in the market.

Note that most of these applications require an enormous amount of energy and fuel which are only as carbon neutral as their source while each application includes different legal and regulatory contexts. A lack of practical examples can easily stale these timelines, for example, if hydrogen, with a higher energy density than natural gas, can be injected into natural gas pipelines or gas-driven applications without blowing pipes or seeping out. As innovation and experiments continue to show promise we’re scurrying to get policy together on issues as basic as how many tubes of condensed hydrogen can be shipped at a time. As is common with any innovation, it can take a moment for regulation to catch up.

With hydrogen there are no silver bullet solutions and, like the greater climate challenge, everything is context-dependent but hydrogen unquestionably offers a unique part of the puzzle. The chicken and egg question of what comes first, the infrastructure or its use cases, will be in the forefront as the innovations come to market and there is more risk-taking from both the public and private spheres. As the urgency for a carbon-neutral world comes hurtling at us, hydrogen will certainly have a part to play.

Writers: Swarnav S Pujari, Daniel Kriozere

If you aren’t absolutely thrilled with The Impact, reply and let us know why. Or you can unsubscribe from all updates by clicking here.

Copyright © The Impact 2021. All Rights Reserved || 19 Morris Ave, Bldg 128, Brooklyn NY 11205