🌶️ Ruminate… Soak… in the hot sauce of this week’s high-impact climate startup news.

Learn about fusion, or perhaps a peek into the hot spice coming out of the industrial sect.

we’re doing great.

THE TL;DR 💨

💰 This Climate Fund is Enabling Industrial Markets to Decarbonize

- Piva Capital is actively looking for companies that are involved in industrial adaptation to make industry greener, more efficient, cheaper, and more productive.

- Piva believes we are now entering a new era of industrial disruption- significant changes in consumer and corporate behavior are accelerating the trend to re-envision industry.

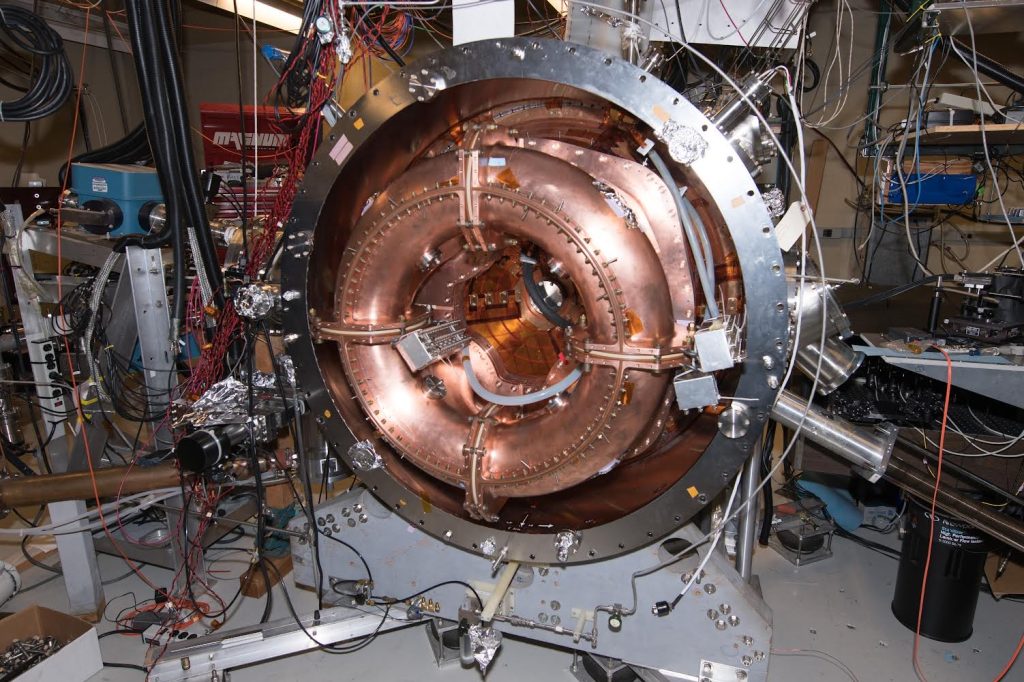

💥 The Spheromak Approach To Fusion • CTFusion

- CTFusion is close to making nuclear power via fusion technology commercially viable.

- Utilizing the Spheromak Approach, a type of magnetic fusion technology, they look to provide a cost-effective, scalable solution to get reactors on the grid.

🌾 Precision Ag’s ‘Right to Repair’ Issue • Howe Neat

- Howe Neat has created a precision agriculture venture that provides farmers the hardware and software they need to customize operations without legal peril.

- The business is cash-flow positive as of today.

💸 VC DEEP DIVE

This Climate Fund is Enabling Industrial Markets to Decarbonize

By Daniel Kriozere • Daniel is a Principal at C3, Tech Scout at For ClimateTech, and Venture Scout at Prithvi - and has an extensive network within the broader climate investment and startup community.

Founded in 2019, Piva Capital backs technology companies bringing new software and hardware solutions to the world’s industrial markets. Piva is actively looking for companies that are involved in industrial adaptation to make industry greener, more efficient, cheaper, and more productive. The three verticals Piva typically invests in early commercial-stage businesses are 1) the future of industry, 2) the future of materials and production, and 3) the future of energy and mobility.

Fund Snapshot

- Stage: Series B

- Initial Check Size: $5M-$10M

- Geography: North America and Europe

- Lead/Follow: Both (prefer to lead)

- Revenue/Valuation Thresholds: Early commercialization

About the Fund

Why was the fund created?

Historically, a shortage of later-stage capital has limited the industrial-scale adoption of promising new technologies. Piva Capital was founded in 2019 by Ricardo Angel and Adzmel Adznan to address the need for industry to transition to a more sustainable, cleaner, smarter future. The firm’s managing partners bring almost 2 decades of individual experience in investing in the industrial space and have built a team with a strong combination of technical expertise to evaluate companies and technology, industrial experience to find the best areas to innovate and disrupt, and experienced investors to identify and support world-changing portfolio companies.

What is Piva’s core belief?

Piva believes we are now entering a new era of industrial disruption- significant changes in consumer and corporate behavior are accelerating the trend to re-envision industry. There is now more capital flowing into the industrial innovation space, and there is a need for investors that can marry technical depth with industrial experience to be able to support companies through their growth journey. Piva is investing in startups that enable industry to become smarter, more sustainable, and to adapt to climate change. The firm focuses on industries that represent over a third of global GDP, and over two-thirds of global GHG Emissions: food, agriculture, energy, transportation, steel, concrete, chemicals, manufacturing, etc.

What domains in climate tech does Piva have the greatest expertise in?

Piva’s team looks at their expertise in two ways – industrial and functional experience. Industrial expertise entails technical and commercial knowledge, which they leverage to evaluate and support companies throughout the technology development, scale-up and market adoption phases. In terms of functional backgrounds, Piva has a diverse set of experiences that span startups, investing, big companies, deep technology development, and more. Additionally, Piva’s team members come from a variety of different roles, from project management to scale and growth and CEOs.

In terms of specific verticals, the team is always learning and developing deeper knowledge in new topics.

What type of portfolio support does Piva provide?

Piva likes to provide real support to startups by rolling up their sleeves for portfolio companies. This can include helping with:

- Business development

- Follow on fundraising

- Storytelling / PR

- Customer acquisition

- Business strategy

- HR (management team hiring, team building, board members, company culture)

Piva also has deep technical expertise in-house. This is not just understanding technology and science, but also scaling technology to maturity for massive industrialization and impact.

About Investments

What is Piva’s investment process and timeline?

Piva tends to track companies and build relationships with teams prior to their fundraising process. The firm’s process is quite straightforward, internally. When a team member is excited about an opportunity, especially after a couple of calls with a startup and market research, the startup is invited to their Monday meeting to pitch to the entire team, including Piva’s advisors. The Piva team sees this as an opportunity to get the entire team excited about the potential company and all the different ways they could support them. After that, Piva’s team privately discusses/debates the opportunity. Ultimately, it takes a couple people to love the deal, and the rest to like the deal to move forward.

What would make Piva consider deviating from their typical criteria?

Piva is opportunistic when looking at deals outside of where they traditionally invest. On the early side, Piva would consider investment if the technology is compelling, differentiated, and if there is no later stage technology in the market already doing something similar. On the later stage, Piva would think about opportunities where companies have hit an inflection point for growth and that fit the thesis of helping industry become smarter and more sustainable.

Sign up for The Impact and discover climate startups & opportunities before it hits the front page

🚀 STARTUPS & TECH

The Spheromak Approach To Fusion • CTFusion

By John Docter • is an Engineering Analyst Fellow for a national laboratory. He's keen on saving the world through science and education.

Fusion is a suitable replacement for fossil fuels because it is carbon-free and provides equal or greater reliability with higher power density working in concert with conventional renewables to provide deep decarbonization across the entire energy ecosystem. This is the future that CEO Derek Sutherland, VP Chris Ajemian, and COO Scott Brennan of CTFusion are working towards.

Fusion is Different from Fission

Fission is conventional nuclear energy, taking heavy elements like uranium and splitting them apart into lighter ones, releasing energy in the process via a nuclear chain reaction. These lighter products are radioactive and require long-term storage, and the nuclear chain reaction creates a risk of meltdown.

Fusion is also a nuclear reaction, and its process is essentially the opposite of fission. Instead, it generates power by combining light and everyday elements, like hydrogen, into heavier ones and releasing energy.

Fusion has Important Advantages Over Fission

Fusion is safer, cleaner, and uses low-cost fuel sources to work. It provides a similar power density as fission, but does not rely on a nuclear chain reaction, thus there’s no risk of a meltdown because it’s physically impossible. Additionally, fusion produces no long-lived radioactive waste with minimal health, safety, and environmental concerns. It’s like fission because it’s carbon-free and creates a lot of energy in a small package, but it’s simply a better product overall if it can be successfully commercialized.

Fusion’s History

Fusion started back in the 1950s and has continued to be a humbling work in progress. What began as something that was thought to be squared away in a decade turned out to be a grand challenge in need of vast amounts of research. Essentially, plasma physics had to be invented in order to make the system work.

The ability to run a fusion power reactor for an extended period of time has been so far away from reality that the most successful versions still haven’t made it past the fictional realm of Marvel movies.

In parallel, computing ability also needed to mature to develop fusion. As computing power developed, so has the field’s ability to simulate and understand how to optimize system performance. This increase in computing power has allowed a better design and optimization of fusion devices. This capability has allowed fusion technology to more rapidly advance towards net-gain, meaning the system makes more power than is put in, which is the basic requirement for any power plant.

Now that the knowledge and systems have matured, the challenge faced by CTFusion and other fusion start-ups is making the technology financially viable.

CTFusion’s Approach

CTFusion uses less superconducting coils than competitors, which lowers cost and space requirements.

Differences in fusion companies are based on technical approaches. There are multiple private fusion companies that are going for net-gain in the 2020’s. With the first commercial units connecting to the grid in the 2030s, fusion is on the precipice of being realized.

Fusion is more or less an artificial sun. There’s a quantity called the Lawson Criterion, which is the plasma density – think of it as the number of particles per cubic meter in this artificial sun, multiplied by the temperature of the fuel and the energy confinement time, which is how well the heat of that sun is retained. As long as the product of those three quantities is high enough at a given temperature, the system can produce net power output. There’s a lot of different approaches to those quantities and that’s what sets companies apart.

In general there’s three main camps of fusion:

- magnetic fusion energy

- magneto inertial fusion

- inertial fusion energy

Each are different ways to balance plasma density and heat retention time. CTFusion belongs to the magnetic fusion energy camp, and is specifically developing the spheromak approach to magnetic fusion energy. Spheromaks are a type of fusion that uses a magnetic bottle to confine a really hot plasma that’s fusing and making power, which is more compact and simple than other approaches.

Consequently, this allows them to have a more compact system which drives down the CapEx required and lowers the projected levelized cost of electricity (LCOE). Since the OpEx and fuel costs are relatively low, reducing capex will reduce the overall cost and make the technology more commercially attractive without sacrificing other features.

Outlook

With the looming threat of climate change, fusion is gaining momentum as a potential solution to meeting global energy demand. While hurdles in development, public acceptance, and implementation remain, fusion shows potential to fulfill a large market need, that is a clean and safe replacement for fossil fuels with the same level of consistent and reliable energy generation. If the team at CTFusion can reach net-gain and commercialize nuclear fusion, it may very well be the technology that eliminates fossil fuels and paves the way to a carbon-free future.

🚀 STARTUPS & TECH

Precision Ag’s ‘Right to Repair’ Issue • Howe Neat

By Jeff Macon • is the venture development manager for Fresno State's Water, Energy, and Technology (WET) Center.

Farmers need to optimize their operations to make do on slim profit margins and to make sure their farmlands are productive. In making their farmlands productive, they minimize inputs such as water, chemical fertilizers, and energy used for irrigation pumps and systems. Additionally, more farmers are working to manage carbon which is being incentivized through carbon-credit markets that are developing around the world. If that wasn’t enough, as farming advances from Agriculture 1.0 to 4.0, farmers are seeking new ways to manage all the proprietary systems in place and the data these systems produce.

‘Right to Repair’ Meets Precision Ag Technology:

The technological makeover of Agriculture 4.0 includes effectively connecting data analytics, nanotechnology, AI, blockchain, drones, and more. In order to unlock the potential of Agriculture 4.0, farmers will need to customize tractors and other equipment. Current precision agriculture solutions are typically applications of technology that are limited to specific use cases and do not provide flexibility to farmers on how they use, repair, or customize them.

Impeding the transition to Agriculture 4.0, manufacturers are incorporating technologies that only allow licensed and certified repair shops to make repairs or customizations on their equipment. This leads to delays in farmers getting their equipment to particular dealers and big-time costs associated with these forced limitations. Some frustrated farmers are hacking their equipment and looking for more open solutions.

Enter Howe Neat:

Daniel Howe runs a precision agriculture venture called Howe Neat which is providing farmers the flexibility with both hardware and software solutions that avoid the ‘right to repair’ limitations placed upon existing products and services. Howe Neat’s proposition to farmers is they pay a portion of the savings of inputs achieved by using their customized and flexible systems. Howe Neat’s position is to take a backseat to farmers so they can optimize systems themselves.

Howe Neat (recently completed Valley Ventures Cohort 6) helps farmers with sustainability efforts by minimizing farming inputs such as water, chemicals, and energy as well as helping them manage their carbon output and sequestration efforts.

How Howe Neat Works:

Howe Neat provides farmers an open platform of hardware and software called neatMon. Their systems are not a pure open-source plan as the company will not provide schematics, board design, or manufacturing information; but, the company provides an open development model based on components of open source but with some protections.

Howe Neat sells solutions to farmers in which they can swap out hardware and software of their irrigation, chemical, and monitoring systems. Farmers particularly appreciate Howe Neat’s flexibility to add improved products such as new sensors to their operations.

Flowmeters are used to make sure irrigation systems are effectively doing their job of providing water, chemical fertilizers, and acids to maintain pH balance to crops. Farmers check flowmeters to make sure the irrigation water includes the right balance of acids and chemicals to optimize products yields and Howe Neat’s systems calculate pump efficiency that can reduce the costs and the carbon that results from overusing the engines behind these irrigation systems.

Howe Neat uses 3-D manufacturing to print its products in-house. This improves logistics and allows them to produce parts that are both economical and customized. Their localized 3-D manufacturing processes also allow them to provide products that are not directly in their product mix when farmers need something specific to make a system work.

Although digital offerings can also communicate in-field operational status to farmers, farmers still need to drive around their operations to check on crops, livestock, pumps, equipment, etc. HoweNeat also works to more efficiently bridge the human-to-machine gap in managing farms to be much more efficient in terms of labor and equipment used to verify operations are running smoothly much like a check-engine light in our vehicles.

Impact:

I am heartened by Howe Neat’s efforts to allow farmers the flexibility to customize their operations. Farmers often complain about the limitations of new, closed-system solutions.

With more open systems, farmers could even share their solutions without legal risks such as voided warranties. If and when farmers create operational efficiencies that have wider market implications, they can monetize and protect these solutions. This not only helps farmers generate additional revenue streams; but, sometimes more importantly, keeps large manufacturers from lumping a farmer’s improvement into their own product offerings and then using the IP initially generated by the farmer against them.

Many precision agricultural solutions claim to save 20 percent or more in terms of inputs such as water and chemicals. If farmers are able to make these reductions, our food, water, and lands would be much more sustainable. If Howe Neat allows farmers to more flexibly deploy these technological solutions, we could expedite agriculture’s efforts to manage climate change.

As farmers begin to incorporate more clean-energy solutions including distributed energy resources (DERs), Howe Neat can provide flexible precision-agriculture technologies farmers can service and customize for their operations.

Reduced costs for farmers is how Howe Neat makes its money. Meanwhile, farmers that work with Howe Neat can increase their profits and maximize other revenue streams such as the IP they create, the transition to clean and distributed energy systems, and the sequestration of carbon in their fields.

☕ CONSIDERING A WAY TO SUPPORT US?

Consider donating if you found this newsletter useful. These dollars are used to support The Impact and our writers as we continue to produce research and insights in the space.

✍️ WANT TO HELP US IMPROVE?

How would you feel if you could no longer receive The Impact?

Editors: Swarnav S Pujari, Stephanie Zulman, Daniel Kriozere Writers: Jeff Macon, John Docter

If you aren’t absolutely thrilled with The Impact, reply and let us know why. Or you can unsubscribe from all updates by clicking here.

Copyright © The Impact 2021. All Rights Reserved || 19 Morris Ave, Bldg 128, Brooklyn NY 11205