Howdy 👋

Did you know The Impact is a team of 10 people who contribute and volunteer their time to share their opinions with you all for free?

If you love what we do on a weekly basis tell a friend by posting on social or texting them a link to subscribe – it motivates us all when we see your friends sign up.

Here’s the link to subscribe – readtheimpact.com 🥰 You and your friends aren’t going to want to miss what’s coming in a few weeks…

– Swarnav S Pujari

In Your Inbox: A thesis on electrolysis becoming affordable like solar, using nuclear to recycle carbon, an interview with Sway

Many have asked whether electrolysis technologies would see cost reduction curves similar to solar panels (solar) or wind turbines (wind). While it may be tempting to assume electrolysis costs will decline at rates similar to energy technologies of the recent past, but it is important to realize these technologies produce fundamentally different products.

Unlike solar or wind, electrolysis produces a nascent product. Power from solar and wind serves the same demand for electric power as dispatchable production assets. Power markets in the US are mature and infrastructure exists to allow for the diffusion of new energy technologies. Ready access to a market, offered by this infrastructure, allowed for the power produced from these new energy technologies to be sold to end consumers. As installations of solar and wind increased, the cost for the technology decreased led by “learning by doing” and economies of scale.

Hydrogen, on the other hand, is different. Essentially all of the hydrogen production capacity in the US reserved for use in industrial activities. In 2014, crude oil refining made up 70% of demand for hydrogen and ammonia production for fertilizer manufacturing made up 20%. Moreover, 95% of hydrogen is produced via a steam methane reformer (SMR) in the US. This demand is realized through bilateral contracts between hydrogen suppliers and consumers – more succinctly, each kilogram of hydrogen produced is produced for a specific customer as there is no market for hydrogen akin to the power market. Even if demand for hydrogen grew beyond these industrial customers, the minimal hydrogen infrastructure in place only connects existing hydrogen supply to large hydrogen customers on the Gulf Coast.

Understanding the nuance of the comparison, the question shifts from “will electrolysis technologies see cost reduction curves similar to solar and wind” to “what changes need to be made in order to see cost reductions for electrolysis technologies?”

If cost reductions for electrolyzers are going to be driven by “learning by doing” and economies of scale, similar to other energy technologies, it is imperative that market structure for hydrogen transactions and infrastructure to move the gas be built. Even still, in a world where a market is established an infrastructure exists, there are still regulatory issues around hydrogen production that must be faced before any substantial decrease in electrolyzer technologies will be realized. Ownership of these assets is at the top of this list.

It could make sense to regulate ownership of electrolysis assets similar to natural gas production wells. After all, hydrogen would likely directly compete with natural gas in many applications. Who would own this electrolysis production capacity? Using natural gas production as a proxy, let’s compare how state-level regulatory structures might shape this question.

Consider the state of Texas. Natural gas production in Texas is regulated by the Railroad Commission through the issuance of drilling permits. Specifically, Statewide Rule 5 mandates any entity seeking to drill a new well in the state may not do so until a permit has been granted by the Railroad Commission – permits are subject to other rules that dictate technical elements of the specific proposal. If demand for hydrogen were to grow beyond industrial applications in Texas, would a new statute need to be drafted by the Texas legislature giving the Railroad Commission jurisdiction over issuing permits to construct hydrogen production facilities? In Texas’s deregulated power market, there is precedent to assume a utility might not own an electrolysis asset based on restructuring, but there is little reason to assume there would be strict limitations concerning ownership of these assets otherwise.

Contrasting with Texas, consider the state of Massachusetts. Massachusetts, has no natural gas reserves or production. In a regulatory sense, the comparison between hydrogen and natural gas production is not possible in the context of Massachusetts – regulatory agencies do not have any regulations on the books concerning natural gas extraction. Therefore, there are no regulations against which one can compare concerning hydrogen production. So, in the case of Massachusetts, who would have the right to own hydrogen production capacity? As a point of reference, if an offshore wind project wanted to maximize revenues by incorporating an electrolyzer to produce hydrogen when power prices were not high enough, there is no regulatory precedent to determine whether they would be allowed to do so. The rules have yet to be written.

So, returning to the initial point, I do not believe costs for hydrogen electrolysis will, necessarily, decline in a fashion similar to solar and wind. This assessment is based on the fact that hydrogen production is feeding into a fundamentally different and nascent market. Given hydrogen will likely displace natural gas for many applications, it is possible that regulation of hydrogen production could look similar to that of natural gas production. But, even using natural gas production as a proxy for a possible regulatory structure is not a feasible across states, as there are many states that do not have any existing policies concerning natural resource extraction.

Will electrolyzer technologies see declining cost curves similar to those of solar and wind? Maybe they will – but, there are layers of market, infrastructure, and regulatory uncertainty facing the future of hydrogen that must be address before we see how cost declines will materialize.

Sign up for The Impact and learn the perspectives behind the latest sustainability trends

It’s not everyday that you see a nuclear startup creating a solution for circular economy, like Neutron Blue. This week Lex Hunstman, the CEO of Neutron Blue, discusses how he is leveraging the power of nuclear to reverse climate change.

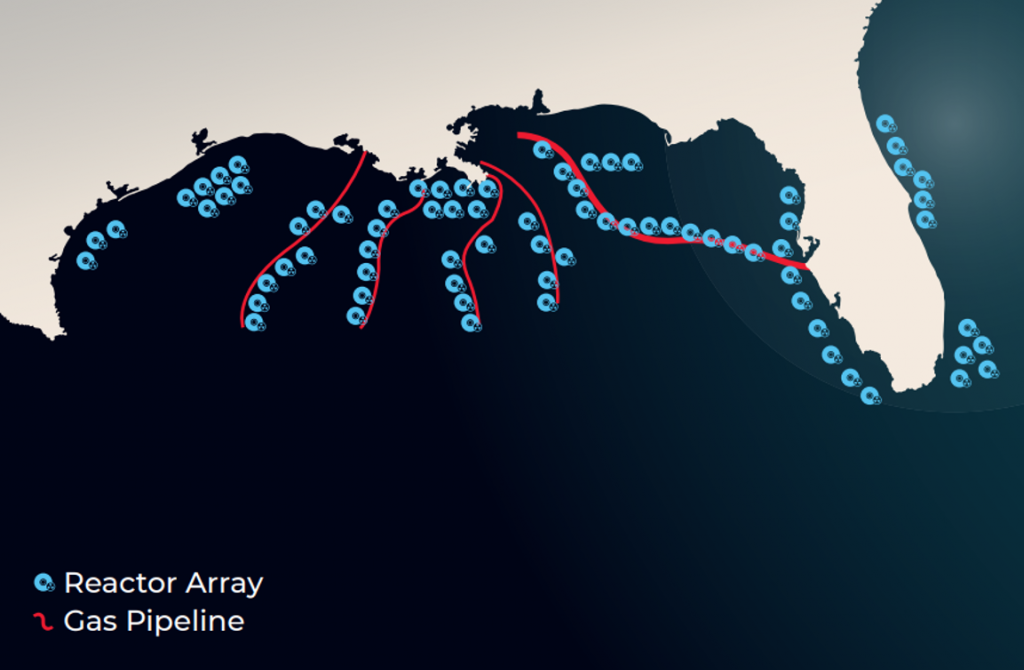

Neutron Blue regenerates carbon back into the existing hydrocarbon infrastructure for use again. We operate small modular platforms subsea where the military has successfully operated hundreds of small modular reactor platforms for decades. We merge state-of-the-art fluids system design mechanics with reactor design and electrochemistry to create an unbelievably cost-effective solution to the carbon problem. On-land and surface based nuclear energy solutions are prone to tremendously more risk than subsea energy platforms, making our technology far more reliable and safer than anything else out there.

Oil and gas (O&G) companies are the main players in the marketplace such as Total, BP, Exxon, Chevron, Halliburton, etc. The current practice for oil and gas production is to extract it from natural deposits which increases the carbon in circulation contributing to climate change.

Let’s back up for a minute and talk about the two ways polyethylene can be made:

In either case, ethylene for polyethylene is made via natural gas components. Therefore, by converting carbon dioxide into methane, the existing polyethylene ecosystem sequesters a portion of that gas into useful solids that don’t return to the atmosphere. So, when an O&G company buys into Neutron Blue, they produce natural gas that is carbon negative.

Furthermore, extracting oil and gas is extremely risky business – a drilling deck is the most hazardous environment that O&G operators work on every day. Regenerated gas is not only better for the environment, but safer for the people in the industry.

Natural Gas is trending right now – it burns cleaner, and the use of cogeneration, fuel cells, and polyethylene production means that natural gas will continue to be an energy staple for years to come. There will only be more plastics, as wood and steel derived products will continue to be replaced with plastics (this is amazing for the environment). More and more companies are pushing for regenerated hydrocarbons, and this trend will continue until not a single cubic foot of gas is extracted due to regenerated carbon technologies.

The ocean is a unknown place whose resources are becoming more known as we innovate to reverse the effects of climate change. From power generation to carbon sequestration, ocean technologies span the gamete for how they can impact life on land. One specific case of this is in plastics, something often thought of as polluting the ocean.

This week, I chatted with Julia Marsh from Sway the Future to discuss how she and her team are using our ocean’s plants to create a new compostable plastics future for consumer products.

“Sway is harnessing the power of seaweed, to create home compostable replacements for single use plastics that are carbon negative, high performance and cost competitive with traditional plastics.”

“My background is in brand and packaging design. I’ve worked with basically every material you can imagine in the CPG, technology, and startup worlds, as well as the broader design world. The challenge I would continually run into is that my career as a designer and as a person in packaging was at total odds with my identity as an environmentalist. I found that this was a problem many of my peers were also experiencing at all different kinds of companies.

The problem is that in most cases, you’re basically obligated to use plastic. It’s oftentimes impossible to create a package-free, recyclable, or reusable solution given how scaled systems of production are designed. So I spent a lot of time diving deep into all of the compostable answers to the packaging problem. I’m really motivated and intrigued by the idea of convenience. I understand that it will take decades for us to evolve consumer behavior and create equitable access to conscious consumption, but we can accelerate that process through materials. There’s this wave of benevolent materials coming … generous materials that help to solve multiple environmental, social and economic crises are being made right now. Seaweed is the most potent opportunity among them.

I grew up in California right next to the ocean. As a kid I visited the ocean practically every day, playing with strands of kelp and exploring tide pools. I understand the ocean and respect the power of ocean ecosystems. I mean, my family literally worked for the Monterey Bay Aquarium! So to me, utilizing seaweed to solve the plastic problem is sort of a no-brainer. Those are some of the puzzle pieces that gave life to Sway.”

“I love the poetry that something from the ocean can help save the ocean. We often look at the ocean as an at-risk-only ecosystem, but it actually has an immense number of solutions – food, energy, and packaging being among them. So I think it makes a lot of sense, as we exhaust resources on land, to look to the ocean and work to sustainably cultivate ocean solutions. There’s so much opportunity to build systems that are regenerative; sourcing content from the ocean, but also creating and supporting healthy ecosystems, mitigating ocean acidity, increasing biodiversity, and providing sustainable employment to coastal communities through the cultivation of sustainable aquaculture. There’s just a lot of opportunity across the board. I think we’re just scratching the surface with the potential that can come from the sea.”

“We’re looking at applications to replace LDPE. It’s a category of single-use plastics that typically has an extremely short lifespan, but they make up the bulk of the material that cannot be recycled. Plastic retail bags, polybags, mailers, pouches, food packaging. This is the flexible stuff that jams up recycling machines when it doesn’t get sorted out. We also see these flexible plastics polluting traditional composting lines. Plus, it’s lightweight, so it floats out of landfills and is more likely to end up in the ocean – according to 5GYRES, bags, wrappers and other flexible films actually make up 40% of the plastic that’s in the sea. 160 millions tons are produced globally every year, and that number is only expected to rise. So there’s a massive amount of this material, it lasts in nature for centuries, and it oftentimes only has a 12-second lifespan before it’s thrown out.

In the conversation around circularity, I think we often forget about biological circularity. At Sway we think, “How cool would it be if we could transform this wasteful material, literal trash which brands are forced to use, into a valuable material that actually replenishes social and ecological systems?”

We can do that with seaweed. We’re creating value for the ocean by cultivating seaweed, but we’re also able to create value through the adoption of home-compostable packaging. Adopting home-compostable materials diverts waste from landfill. We’re able to replace the non-recyclable items like wrappers, bags, and pouches, but we’re also contributing to composting behavior and the accumulation of more healthy, nutrient-rich compost – which then feeds the immense potential of scaled regenerative agriculture!”

“First, the role we play at the moment is ensuring that seaweed cultivators, farmers, and processors understand that there’s a major demand for seaweed and bridging the gap in processing is a major focus for us. Currently seaweed’s primarily used for food, pharmaceuticals, and beauty products. Packaging is like the next step that needs to happen in order for the Blue Economy to really open up and bloom.

The second relationship we’re developing (which is more related to the Blue Economy as a whole) is our ability to really measure the impact that we’re having in the water. Seaweed is really a marine ecosystem architect. It provides habitats for hundreds of species and encourages biodiversity. When you’re harvesting it, ideally you’re basically giving it a haircut. The other related opportunity is to work directly with farmers, ensuring that they’re being provided reliable employment over extended periods of time – especially in regions affected by overfishing. There’s a lot of opportunity to create radically good impact for both people and the planet through the cultivation of seaweed.”

“Increased access to compost infrastructure. Just in the past few years we’ve seen great leaps in terms of how many Americans have access to a compost facility which accepts compostable packaging. I think the Sustainable Packaging Coalition reported it’s now up to 21%, and we’re only going to see that number increase. So naturally, we need to design solutions that fit into that waste recovery stream. The second piece of that is all of the consumer education which needs to happen around the differences and nuances between all of these emerging new materials.”

Smart labeling, as well as building out data frameworks that give people access to information with ease. One plan is to use QR codes to guide people towards composting resources: Where’s the nearest compost? How do you set up a compost at your home, even if you’re living in New York City or Los Angeles? There’s a huge opportunity to bring people into the movement through information, and simple tools that make “doing the right thing” easy and empowering.

I think it comes from the top. It’s collaboration from the heads of packaging and procurement at every major CPG coming together and saying, ‘We understand that there needs to be an ecosystem of new materials to solve the plastic problem, and there is no silver bullet. With our shared beliefs and attitudes around the future of the planet, we can build new systems that really look holistically at packaging production, distribution and use. And together, we’re going to implement those solutions to make real positive change.’ That kind of collaboration needs to be combined with a commitment to avoiding the sins of greenwashing, and really I think that’s the biggest barrier.

The material that we’ve produced is heat sealable, moisture resilient, nontoxic, and completely transparent. If you saw it, without having any context about Sway, you would assume that it was traditional plastic. We’ve received feedback that folks want to see materials that look like they’re compostable, and look like they’re made from a bio-based material because it’s more likely that that kind of material will get composted, so we’re now interested in also integrating less processed seaweed fiber into our product.

The way that we’re designing our technology, the only barriers to scale are sustainably sourcing and processing the raw seaweed material. We have spent a lot of time and effort in stitching together a powerful network of suppliers and processors to enable us to deliver a commercial product, but as Sway scales, we’re going to need a lot more processors and more processing capacity.

In addition to our full commitment to replenishing the planet, I think there’s this awesome opportunity to give people direct access to the folks who are making Sway materials. It gives the average person the opportunity to see how the material is being grown and cultivated in the ocean, and how it’s being processed; what the end of the ideal end of life is; that after being composted we’re creating healthy soil; and so on. I think the more information and traceability that’s available to the consumer, the more likely they are to feel empowered by their choice to partake in that brand ecosystem. Sway enables brands to increase consumer loyalty, which means that ultimately we’re not just delivering value to the brands that we’re working with, but, you know…real people.

There is no doubt that the plastics pollution problem is severe. Specific to polyethylene (the greater family of low-density polyethylene (LDPE)) contributes 22.67 million metric tonnes of plastic production (Statista). While the material is theoretically 100% recyclable, contamination and recycling capacity fail to make this a reality.

However, Sway’s use of seaweed for LDPE applications may begin to bypass recyclability and go straight to biodegradability, which can streamline the process for regenerative plastics for consumer goods and products. However, with biodegradability comes the cost of methane, a greenhouse gas that has a 25x worse effect than CO2. While it is true that methane escapes the atmosphere faster, the effects are still real. If Sway’s product can output minimal amounts of methane in its compositing process, and its life-cycle analysis yield a carbon-neutral/carbon-negative impact, Sway becomes more than just a bioplastic.

With the rise of ESG, there is a heavy incentive for companies to integrate renewable/regenerative solutions into their supply chains, as well as account for end-of-life uses for their products. This comes with a degree of accountability. Therefore, incorporating products such as Sway’s into their product ecosystem will be beneficial to green-label additional parts of their products, as well as claim to be more environmentally responsible. However, the world of consumer products is no longer one where the selling company alone should get the limelight and notoriety, but suppliers are being pushed to the forefront to show they are environmentally responsible as well. Sway’s market-timing is impeccable for this, as they have an opportunity (and almost an obligation) to be consumer-facing even though their product is not the main component of what is being sold. Julia Marsh and the team have an opportunity to define how suppliers make their name in CPG markets to eco-conscious consumers.

All-in-all, Sway has to be able to displace current plastics from supply chains, which is easier said than done, and prove out that not only can their product fit into existing machinery and supply-chain infrastructures, but also exhibit the same material properties at the same or better levels. There is a lot of pressure on Sway the Future to lead the charge for disrupting plastics consumption for LDPE using regenerative macroalgae in seaweed, but the timing and product they do have may very well be a cut above the rest.

Editors: Swarnav S Pujari, Daniel Kriozere Writers: Matthew Morris, Drake Daniel Hernandez

If you aren’t absolutely thrilled with The Impact, reply and let us know why. Or you can unsubscribe from all updates by clicking here.

Copyright © The Impact 2021. All Rights Reserved || 19 Morris Ave, Bldg 128, Brooklyn NY 11205

Develop your market map of up-and-coming climate startups and market opportunities by subscribing to our weekly newsletter for free.