Howdy 👋

New podcast! You all seemed to love our last show so you’re going to love this one where Max Webster from Version One VC came on to explain how bitcoin mining and solar can enhance the economics of currently backlogged solar farms.

He also mentioned the kind of companies he is looking to fund in the energy space – so make sure to watch until the end to see if you should pitch him your startup!

Also we ran a follow up piece on the hugely popular project finance vs. VC below – this is one highly packed week of content.

Enjoy.

– Swarnav S Pujari

In Your Inbox: The potential value of bitcoin mining with solar; A follow up to Project Finance vs. VC with HG Ventures; Wave Power systems are getting the funding they need with new grants.

Max Webster from Version One VC came on our show Contrarian Climate to explain why he thinks including Bitcoin in every solar system can deliver immense value to existing solar systems.

Basically his entire thesis is summed up as – Bitcoin is the buyer of last resort for excess and unused solar.

In this conversation we dive into the depths of how and why he believes the relationship between the rise of Bitcoin and the falling prices of solar are directly related. Bitcoin in theory could help accelerate the adoption rate of solar.

Check out and subscribe to our Youtube Channel for future episodes!

Sign up for The Impact and learn the perspectives behind the latest sustainability trends

This week Ginger Rothrock, Senior Director of HG Ventures, talks about HG Ventures in relation to the broader investment ecosystem.

HG Ventures launched back in 2018 as the corporate venture arm of the Heritage Group, a multibillion-dollar private Midwest conglomerate in the traditional industrial sectors of construction, environmental services and specialty chemicals.

As the corporate venture arm of the Heritage Group, we look at leveraging the people, the assets, and the relationships of our operating companies and our R&D group to support STEM entrepreneurs in scaling their business. We are a group of investing professionals that can bring the knowledge and expertise one would expect of an institutional VC, but also provide access to markets in which we operate.

We have a hybrid model – so, we are a corporate venture arm in that we invest $50M per year off the balance sheet. This puts us in the range of a $350M-$500M institutional fund. Our initial investment is between $1M-$10M, and we have capital set aside for follow-on funding. To date, we have deployed somewhere around $120M. Our investment process is like that of an institutional VC, in terms of timing, termsheet, and deal docs.

Also, we have patient capital, and I am not measured in the same way in which my institutional venture colleagues are measured. My LP is my corporate, The Heritage Group, and the leadership understands the time and capital it takes to get from the lab to commercial in the materials science and sustainability sectors, or even to positive EBITDA. As a result, we as a venture group don’t need to drive liquidity events. We’re a 90 year old industrial company that has historically bought and built companies for life. Future M&A is also not a focus for our group.

The main filter we use for investment opportunities is: can the Heritage Group help? So how does HG Ventures help entrepreneurs? How do people add value more than money?

This depends on the company. It can be a deep market insight, such as development of a supply chain or simple pricing intelligence – how much certain chemicals are selling for. We can provide talent resources (from The Heritage Group) if companies are struggling with purity or scale up. Also, we have a bunch of plants and processes – we welcome founders to visit us, and let our engineers look at your drawings for your plants. Pilots are another thing we can provide.

A lot of the companies in our sectors face these first pilot or sales cycle risks. These startup companies are selling their products to industrial corporations, which don’t exactly move at startup speed. Startups need validation from others, so we’ve been a pilot tester and a customer for about a third of our portfolio companies. It’s also a significant part of our Techstars program focused on material science and sustainability. The way HG Ventures operates creates a win-win scenario, for the startups and The Heritage Group.

While we want to bring lots of value to our startups, we want to act like an independent venture fund. We do not require any business unit sign offs to do investments.

We sit on companies’ boards, and we must be a fiduciary for that company. So, any business relationship between our startups and the Heritage Group is an is an independent transaction that we encourage and support, but do not necessarily get involved with. Some of the startups we have invested in have The Heritage Group as a customer. Others may be customers of our customers (especially for Heritage Environmental, the largest private environmental services company in the US that manages waste streams for over 1000 industrial clients).

HG Ventures can invest in startups that are adjacent to The Heritage Group business sectors. ;we can also invest in startups that may eventually disrupt our existing business(es).

We choose investments similar to traditional VC, in that we care about the team, market, and product (typically in that order). We invest in companies where we can help.

The sectors we invest in are: construction/infrastructure, environmental services (waste, circular economy), specialty chemicals, materials (construction, chemicals, synth bio, waste), automation.

Our investments are stage and geography agnostic, with our first check size typically $1M-$10M. Anything that is pre-seed falls more into alignment with our accelerator program with Techstars.

Our entire company has been focused on sustainability and, relatedly, climate impact since the very beginning. We’ve got a 50-year-old sustainability business, and we’ve been doing zero waste and waste reuse programs long before it was popular – it’s just good business. Our construction business was one of the industry leaders in use of recycled materials. Our fleets are converting to electric. So, this new “VC focus” in measuring sustainability and climate impact is something that has been an inherent value of ours since inception.

I’m very excited about this whole democratization of entrepreneurship. So far, we’ve seen universities include entrepreneurial programs for scientists and engineers and an online ecosystem flourish with individuals sharing advice and resources. However, there seems to be a lack of content relevant to the STEM entrepreneur, relatively speaking.

One of our big ambitions for the future is to develop our brand and reputation as a source of capital for these STEM entrepreneurs. We’re starting to figure out how to develop and distribute meaningful resources on topics like ideation, company formation, fundraising, industrial scale up, etc.

It is my intention that STEM entrepreneurs gain easy access to content tailored to their specific questions and needs, and I want us to be a bigger contributor and a positive contributor to this growing ecosystem.

As I explore the problem of investing and financing innovation to combat climate change, I am convinced that traditional investment is not the solution. As I wrote about previously, the path forward will include finding a new way to assess and underwrite technology risk to help earlier stage technologies deploy, as well as creating new vehicles/structures for funding.

Corporate VC provides a unique offering, relative to other financing options in the climatetech/cleantech sector. This cooperation between The Heritage Group and HG Ventures enables deployment of capital into solutions that may not normally be a great fit for VC or project finance.

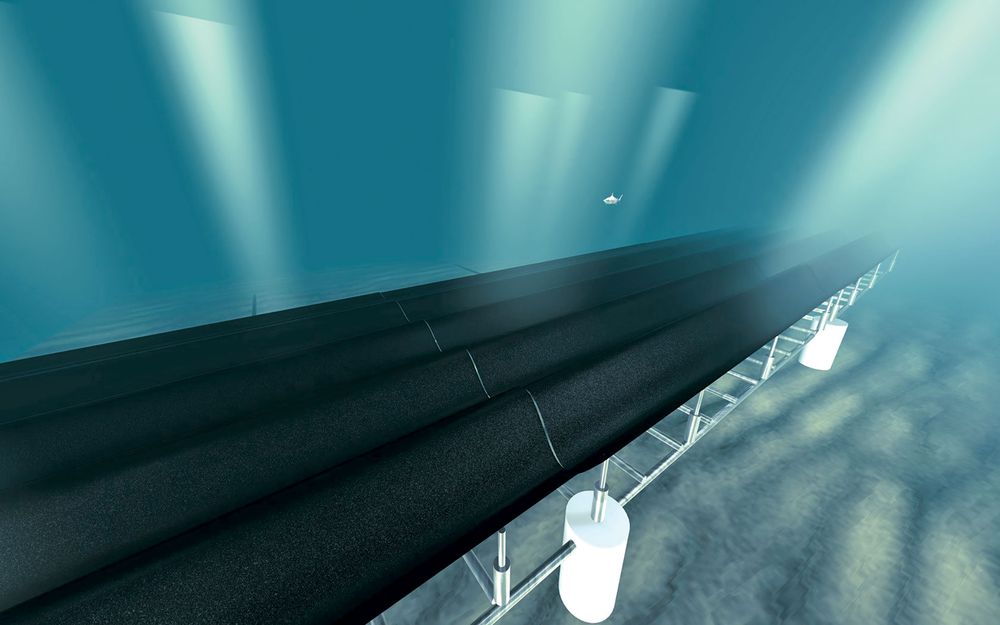

While the world’s coastlines will not be covered in wave energy collectors (WECs), the addition of such technology provides a stable, consistent renewable resource with little detriment to marine life. Unlike offshore wind, which (at the moment) requires drilling into the ocean floor and erecting massive structures that some people living on the coast may not want to see outside their homes (*cough* Cape Wind), buoyant devices capable of capturing energy without becoming an eyesore may be able to grab more attention and acceptance should WECs obtain competitive LCOEs.

Investment in WEC research at the lab scale is crucial right now, as PacWave, the DoE-funded wave testing site in Oregon, is scheduled to begin construction South Site this summer, and is expected to be completed in 2023. This facility will be larger and deeper than the North Site, which is closer to shore and in shallower waters, allowing for large, high-power rated systems to begin field testing and solidify researchers’ proof-of-concept of mid- and full-sized systems. Successfully technologies emerging from this test site will pave the wave for wider adoption of wave power.

Writers: Swarnav S Pujari, Daniel Kriozere

If you aren’t absolutely thrilled with The Impact, reply and let us know why. Or you can unsubscribe from all updates by clicking here.

Copyright © The Impact 2021. All Rights Reserved || 19 Morris Ave, Bldg 128, Brooklyn NY 11205

Develop your market map of up-and-coming climate startups and market opportunities by subscribing to our weekly newsletter for free.