Howdy 👋

So the unofficial, official Miami Tech Week happened – I wasn’t there…but if Twitter is good for anything the threads from all the VCs that did attend are a great way to live vicariously through their tweets.

Maybe we should do a Miami Clean Tech Week 🤔 Complete with paper cups, an EV car show and recycled fabric Patagonia jackets. Oh and powered by floating solar panels…Let me know if you’d be interested and we’ll tweet at the Miami Mayor.

– Swarnav S Pujari

In Your Inbox: What is the value of avoiding climate tipping points; Organic Waste Management; Why we need to invest in climate tech now

How to value a climate-normalizing technology, or enterprise?

This is an vast and complex subject. One important approach is this: let’s think about how to value climate-normalizing solutions on the basis of whether they’re deployable rapidly, creating climate benefits in years, not decades. These would be particularly critical if earth is nearing a set of tipping points – points where small increments cause substantial and irreversible alteration to the climate.

Each climate tech solution aims to tackle some niche of the global climate crisis. We value these technologies as substitutes – where we may pay a small price premium for the betterment of society, but little more. Then, there is no way to see one niche, one narrow technology, as more or less vital than the next.

We need to change the calculation for climate tech solutions. The focus needs to be on the impact these solutions have toward reversing us away from tipping points on the scale towards full global meltdown. Thus, we need to rethink how society, governments and groups can view the value of climate technologies, and create prioritized solutions to prioritized problems.

We are moving, seemingly inexorably, toward multiple tipping points, each of which creates a change from which it is hard to come back. There are some well-known examples: Amazon forest dieback is accelerated by deforestation. Methane release from Siberian permafrost is accelerated by increasing temperatures. Disruption of monsoons or of the Atlantic circulation (the warming stream that keeps Europe’s temperatures moderate), among others.

Clearly the probable existence of irreversible points-of-no-return in climate damage would put a tremendous premium on solutions – behavioral, carbon sequestration, and other solutions – to be put in place before the entire climate collapses. Reading the scientific literature on this is breathtaking: sober discussions and thoughtful, quantitative analyses where the unspoken “if we get this wrong” consequences may include the obliteration of humanity.

Understanding the nature of such tipping points, at a quantitative level, is key to assessing how fast we must act and extending on this, to be blunt, how much we should spend. Some of the climate-disrupting actions – combatting Amazon forest dieback on the ground in Brazil and Peru – may be more tractable economically and logistically in relatively short timescales than others – large-scale active carbon sequestration, perhaps.

A short-term, large-scale investment directed at reversing or preventing the fast-onset tipping points might have greater beneficial outcomes than a broader approach. Sounds reasonable? Where to start? Given the current, retrograde stance of Brazil, it might be easier to start elsewhere in the region, aiming to simultaneously get the science and the economics right, and to start building the ability to reverse out of tipping points.

So, it’s interesting to see analyses that start to distinguish between fast-onset tipping mechanisms and slower-acting ones.

A paper in Nature this month moves this forward, with some key conclusions:

So, while carbon sequestration (for example) is imperative in steering the climate toward a tolerable future, reversing tippings is also key. And some tipping events can be more easily and more rapidly reversed than others.

And this provides a new way to think about the challenges, particularly the costs, of re-balancing, renormalizing our climate. For each tipping point, we can imagine a complete cost.

The consequences may be different, even wildly different, from a complete cost based only on gross carbon sequestration – for example, a cost to capture carbon dioxide or methane from the atmosphere to bring levels to appropriate levels. But the carbon capture estimates do not take into account the multiple looming tipping points, and the direction described here does.

Sign up for The Impact and learn the perspectives behind the latest sustainability trends

Food waste is an enormous environmental, social and economic problem. The issue at hand has as much to do with the need for innovation but also for regulatory-induced alignment of incentives.

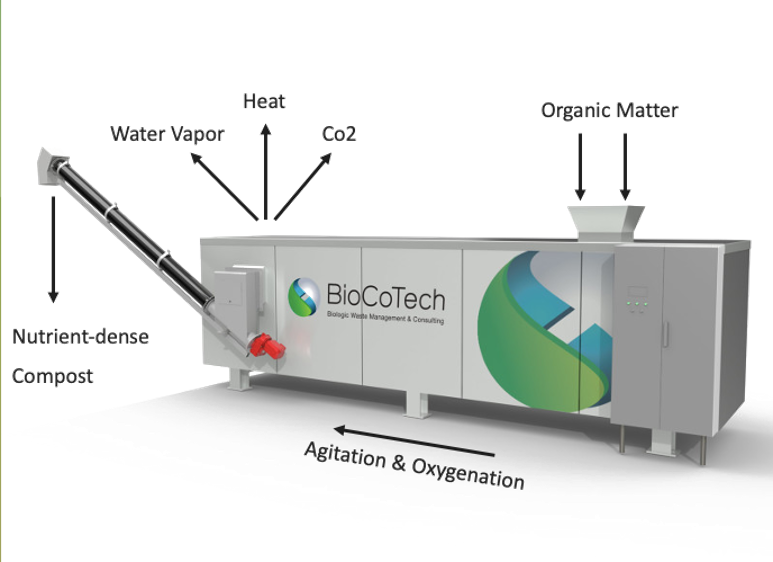

This week, Tanner Farrow, the Director of Operations of BioCoTech Americas, discussed what he is working on. BioCoTech Americas’ mission is to create value within the waste management system by allowing businesses to effortlessly process organic waste on-site. Below are the key takeaways from the conversation.

Governments, industries, and businesses across all sectors are on the fast track towards creating a Circular Economy. With the rise of urban gardens, hydroponics, cultured meat, aquaponics, and so on, BioCoTech Americas envisions a decentralized food supply system – organic waste can easily be recycled with their technology and nutrient-rich compost can be used locally to grow food.

We talked with Max Webster from Version One VC about how Bitcoin Mining with Solar can help accelerate the adoption of solar. His thesis is that when Bitcoin Mining is used to mine Bitcoin during times of abundant or excess solar power you can make solar more profitable. As Bitcoin’s price stabilizes and continues to grow, Bitcoin becomes a great source of value for excess solar power that would have been lost. He also discusses how Bitcoin Mining can and should be explored as a flexible load for solar.

Editors: Swarnav S Pujari, Daniel Kriozere Writers: John Connor Ryan, Tristan Pollock

If you aren’t absolutely thrilled with The Impact, reply and let us know why. Or you can unsubscribe from all updates by clicking here.

Copyright © The Impact 2021. All Rights Reserved || 19 Morris Ave, Bldg 128, Brooklyn NY 11205

Develop your market map of up-and-coming climate startups and market opportunities by subscribing to our weekly newsletter for free.