The Impact

A guest from Softbank, opinions on E-Mobility

To: The Impact Readers

Howdy 👋

We have two guests today – one from Softbank and a Founder in Cleantech! Exciting perspectives to say the least!

This week I dove into the The American Jobs Plan Biden proposed and corresponding tax plan to fund his efforts. Fun stuff, especially when you have to read pages of tax documentation just to understand what’s actually going on…

Some fascinating reads for you below from our writers and yours truly. Enjoy.

– Swarnav S Pujari

In Your Inbox: Biden’s Tax Plan supports the clean economy in a different way; The EV race has heated up; How every job is a climate job; plant based building insulation materials

🚀 STARTUPS & TECH

E-mobility has won the race: VW

By Chetan Agarwal • Chetan works as a General Manager in the Energy Business of SoftBank in Tokyo.

Volkswagen held its first ‘Power Day’ event on March 15th 2021. The CEO announced, “e-mobility has won the race” and laid out the company’s vision for battery technology, charging infrastructure, and expanding its own battery manufacturing capacity.

Within VW, the share of BEVs is expected to increase to upto 60% by 2030, leading to a demand of 240 GWh battery capacity in Europe alone. To address this demand, VW is planning to set-up 6 manufacturing facilities of 40 GWh each.

Sounds simple enough? So how will VW actually go about achieving this? Let’s breakdown what VW is really planning to do on e-mobility. They have come up with 2 main pillars to achieve their goal of 60% internal BEV share:

Pillar 1: Battery Cell & System

Pillar 2: Charging & Energy

VW has announced pretty radical measures related to both pillars, so let’s dig-in.

Components of Pillar 1:

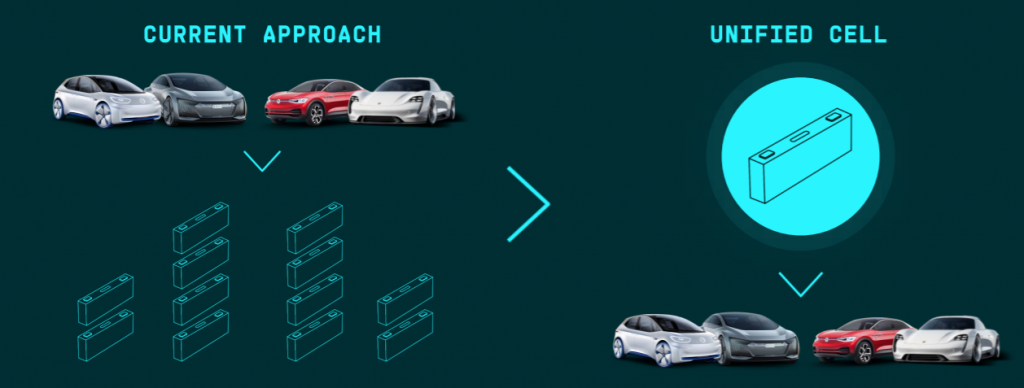

a) Unified cell approach: for 80% of the cases, the basic cells within the battery do not need to change. For 20% specialized cases, cells can be different. However, today this is not being followed

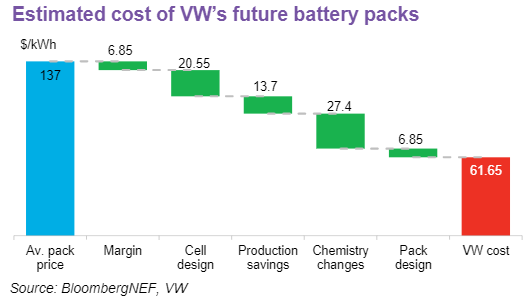

b) Reduction in battery costs by 50%: VW’s announced performance improvements across cell design, manufacturing and chemistry will result in a 50% saving to its battery systems. Based on 2020 pack prices of $137/kWh this would put VW’s packs at $61/kWh. The company could achieve this as early as 2025

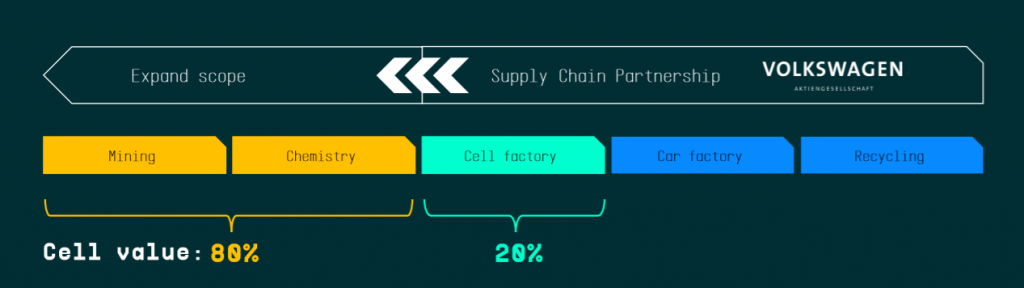

c) Backward integration of the value chain: VW has figured that cell manufacturing alone accounts for only 20% of the economic value for a battery. Hence, they have decided to expand to raw materials, refining, precursor and cathode materials as well which accounts for 80% of the economic value of the battery.

Together with selected strategic partners, Volkswagen therefore wants to secure the long-term supply of cells for its e-offensive

d) Recycling 95% of the raw materials: to reduce costs, lower the CO2 emissions from manufacturing, VW plans to recycle 95% of the raw materials which go into a battery.

The first recycling plant has been already set-up in Salzgitter and production started in January 2021

Components of Pillar 2

a) Large-scale expansion of fast charging network: Volkswagen’s battery offensive is being accompanied by a large-scale expansion of the fast-charging network. Along with its partners, the company intends to operate about 18,000 public fast-charging points in Europe by 2025. This represents a five-fold expansion of the fast-charging network compared to today and corresponds to about one third of the total demand predicted on the continent for 2025.

b) Strategic partnerships for charging: VW is entering into several strategic partnerships to establish this fast charging network

Ionity → Europe

Enel → Italy

Iberdola → Spain

Ionity → Europe

BP → UK, Germany

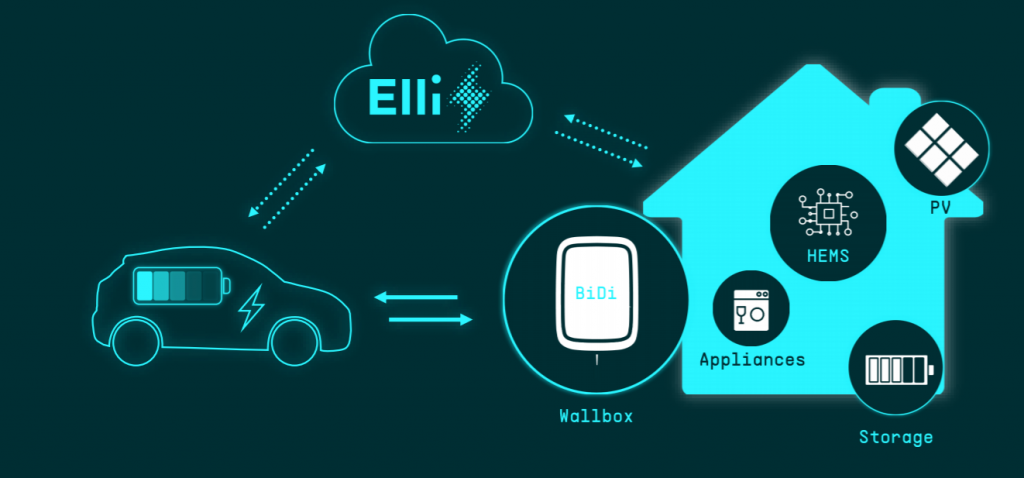

c) BEV to become a mobile power bank: this one is pretty radical. Volkswagen intends to integrate the electric car in private, commercial and public energy systems in the future. This will allow green electricity from the solar energy system to be stored in the vehicle and fed back into the home network if needed. Not only will customers be more independent of the public power grid, they will also save money and reduce CO2 emissions. Models based on Volkswagen’s own MEB platform will support this technology from 2022

All in all, it’s a brave and bold roadmap which VW has laid out for itself. I especially love the fact that their focus is on reducing complexity while adopting e-mobility as their core business.

Sign up for The Impact and learn the perspectives behind the latest sustainability trends

📃 POLICY & FINANCE

Biden's Climate Tax Plan | How Attacking Profit Shifting Unlocks Billions In Clean Infrastructure Financing

By Swarnav S Pujari • he is the CEO of TouchLight - an energy company that enables companies with renewable energy procurement goals to source low cost and local renewable power.

The biggest and most complex part of The American Jobs Plan and corresponding funding strategy through The Made In America Tax Plan – is how climate infrastructure is going to get the necessary government support it needs.

If you read through the above linked documents, the immediate response you’re likely to have is that most of the target funding focuses are going to be surrounding infrastructure rehab and incentivizing the private sector to invest into US R&D and manufacturing.

Effectively the priority statement is to build a true – Made in America standard.

However, we can quickly see that the climate and resiliency focus of the plan isn’t as defined as one would like it to be from an initial read through.

The Made In America Tax Plan Banks On Cutting Fossil Fuel Subsidies And Re-Working Existing Investment Tax Credits (ITCs)

Cutting direct fossil fuel subsidies is very much a political move rather than a concrete “defund the fossil fuel industry” type move as explained well by David Roberts.

However, as you read into the performance of using ITCs for incentivizing solar development you suddenly see some logic in continuing this approach. Tax Equity investors made a killing with solar development and financing, so it’s only natural to believe that if ITCs were created to drive additional energy storage installations and upgrading our High Voltage transmission lines we’d see 10s of Billions in annual capital being deployed into the space on a year to year basis.

The Problem Is 10s of Billions Per Year Is A Drop In The Bucket To Rebuild Our Infrastructure To Aid Our Climate

Investment over the next 10 years needs to be in the 100s of Billions if not Trillions to rehab, if not replace, all of our existing infrastructure.

President Biden factors for the 100s of Billions we need indirectly in his Made in America Tax Plan

The tax plan directly attacks profit shifting by corporations – a simple example of this is Apple, one of the most cash rich and liquid companies in the US, if not globally, uses existing tax loopholes by moving capital into different countries to avoid a large income tax liability.

Proposed approaches range from getting global buy in to stop enabling profit shifting to avoid income tax liabilities to setting a baseline corporate tax rate across the board as a way to ensure that the capital is there to fund this $2 Trillion infrastructure plan President Biden is proposing.

Stopping Profit Shifting Is Harder Than A Minimum Corporate Tax Rate. It’s Nerve Racking To Think That’s Where We Want to Pull Our Funding From For This Plan.

Accountants are smart and by the time this passes through the hands of congress and every democrat and republican has a chance to put their stamp of approval on this plan – there will be loopholes available for a smart accountant to find.

Corporations fundamentally want to maximize profits at all costs as that’s what shareholders will demand. These days shareholders have begun to demand high ESG standards and require corporations to form sustainability budgets.

This helps in the overall funding available for climate related efforts – including infrastructure rehab – but it doesn’t deliver enough to solve the problem.

If Blocking Profit Shifting Works – ITCs Will Become The Most Valuable Income Tax Reduction Tool For Large Corporations – Bringing 100s of Billions In Private Funding To Climate Infrastructure.

When we think about how instrumental ITCs have been as a method of accelerating solar infrastructure development at the residential to utility scale level – It suddenly becomes easy to see why if corporations became participating tax equity investors in renewable energy or climate infrastructure related projects – we’d unlock billions in capital that wasn’t being leveraged before.

Regardless of your stance on tax credits in general – it is a proven subsidy path that has driven solar adoption up and to the right.

If it were possible to drive corporations to invest alongside the government through ITCs into climate focused infrastructure we’d hit our carbon neutral goals by 2030 with the existing technology we have today and breakthroughs being commercialized as we speak.

The Fear Is If Blocking Profit Shifting Becomes A Political Battleground.

It’s not a fear as much as a concern that this proposed legislation is going to have a strong division in congress. Those that tend to believe that we should reduce taxes tend to not believe in the governments ability to spend that money effectively and on the flip side those who do believe in fair taxation tend to trust those in office to spend and allocate capital effectively.

Regardless of the side you’re on in this debate – the biggest component as it relates to the climate infrastructure funding we need is how the money is going to be sourced. Some may say defund any incentives for the fossil fuel industry, effectively a carbon tax – which will be faced with deadly political war. Some may say create ITCs for every key piece of infrastructure we need built out – but then the dependency on independent tax equity funds to funnel all the capital in, meaning lower yield projects will not get the funding it needs.

In The Climate Funding Question The Plan Can’t Depend On Partisan Legislation

In general it doesn’t matter what side people are on, their perspective could be right or it could be wrong. I personally would love to see Congress and President Biden succeed in getting this plan through just because I see the huge upside it brings to accelerating infrastructure development.

How To Make The Made In America Tax Plan Bi-Partisan As It Relates To Climate Infrastructure.

Though I’m not an export on tax laws – here’s my proposed approach. Through a form of a tax – set a minimum tax rate for corporations, earning above a certain dollar amount, to contribute towards a national climate infrastructure fund.

This way we can tax corporations without having to fight over profit shifting or fossil fuel subsidies – instead forcing all corporations to allocated part of their revenue toward sustainability/climate infrastructure the form of a tax would likely drive the capital needed to fund the $2 Trillion infrastructure plan being proposed.

If we assume that climate and resiliency is now a bi-partisan topic – climate funding via a tax, which may be avoidable through the direct investment into qualified climate infrastructure projects, could help create a 10 year plan that all sides will be acceptable with.

🚀 STARTUPS & TECH

Working on saving the planet: Even robots will get a green collar job

By Samuel Bühlmann • Sam is the Founder of Project Oasis where you can explore low and high-tech climate solutions and get marketing support.

Sustainability is snacking job descriptions.

Moving from conservation to regulation and investment, green jobs are now expanding throughout the economy. I wonder how this trend will affect the types and numbers of jobs.

Imagine Bill Gates and Vinod Khosla debating this in a bar.

Bill: “Innovation is hard to schedule but with lots of inventors some will succeed.”

Vinod: “We firmly believe it will take only 12-15 entrepreneurs to reverse our current course regarding climate”.

At this point António jumps into the conversation “Guys, the green economy will create 24 million new jobs by 2030”.

If the massive efforts towards a low-carbon economy produces 12 breakthrough innovations that each helps create 2 million jobs within the next ten years – they were all right.

Many shades of green jobs

Today, the push to replace a white with a green collar is real and that is great. Yet, the titles on green job boards sound quite familiar: data scientist, designer, product owner, project or sales manager. Of course they are within climate-related organizations, but maybe it’s an illusion that we can continue our careers as business managers or software engineers and reverse climate change. Maybe effectively taking care of patient earth requires much more radical career shifts. A workforce of oceanographers, soil scientists, meteorologists, geologists, hydrologists, farmers, foresters, recyclers and renewable energy engineers, paired with a whole new generation of professions such as air-miners and bio-hackers.

What if we had to reinvent work by tomorrow

A thought experiment could reveal what the jobs of the future are: what if heavy-emitting activities were banned by the end of the year – how will necessity and urgency as the parents of invention affect our work? What are the changes that need to happen in your workplace and industry by tomorrow? When we have some answers we can start to imagine what kind of jobs there could be. As if this wasn’t already difficult enough, we are also in the middle of defining a new normal, discussing the impact of automation and alternative compensation forms like an universal basic income. How will this all come together?

Every job can already support the environment

I believe that everyone can already make a difference in their existing job: switch a supplier, reduce waste or start a task force. Changemakers are everywhere. Obviously the individual impact can differ, but overall contributing to saving the planet is not a privilege or duty assigned to a few positions. Ideally, in the future each job would have a neutral or negative footprint and each human and machine would become a climate-positive force.

Until then, reversing climate change will be a tough achievement. Whether it will be robots or humans, 12 or 100 breakthroughs and 24 or 100 million new jobs, in the next ten years, many minds and hands will work hard, form collaborative clouds and eventually a few sweat drops will reach the earth. These indispensable breakthrough drops will give life to new markets and activities.

🚀 STARTUPS & TECH

A Green Solution for Insulation Materials, Hempitecture

By Daniel Kriozere • is a Business Analyst at Lawrence Livermore National Laboratory and aspiring investor & advisor to clean-tech startups.

Green buildings are trending now more than ever. With that comes innovation with energy efficiency, HVAC optimization, and green materials. In particular, insulation is one of the fastest growing segments of the construction market, due to the increased focus on improving the energy efficiency of the built environment, which is currently responsible for approximately 40% of our domestic energy consumption and carbon footprint.

Matthew Mead, Founder and CEO of Hempitecture, explained in a short interview how they are bringing sustainable, plant-based insulation to your home.

Can you describe what your company does and the impact?

Hempitecture specializes in biobased building materials primarily derived from rapidly renewable industrial hemp. Industrial hemp fiber is an ideal feedstock for building materials because it is a strong, resilient fiber, that also captures carbon dioxide during its growth. By utilizing this carbon capturing natural fiber into our materials, our products are high performing, highly insulating, and non-toxic, all while have a low embodied energy and carbon footprint.

Hempitecture is a unique company in the building materials space because a large portion of our competitors have products that inherently lack sustainability, whereas Hempitecture’s products embody both health and sustainability.

Our products benefit both people and planet, in that they contribute to healthier indoor air quality and sequestration of greenhouse gasses, while simultaneously providing opportunities for rural communities where our material feedstock is produced.

What does the future look like?

There will be an increased importance on selecting insulation products based on their carbon footprint, due to the fact that many insulation products which seek to reduce energy loads and reduce carbon emissions, are manufactured with carbon intensive materials or processes.

Hempitecture is solving this need in a sustainable way, as the material sequesters carbon as it grows. While it is more cost-effective to add insulation during construction than to retrofit it after construction is finished, and replacing current insulation with Hempitecture may be worth it.

Writers: Swarnav S Pujari, Daniel Kriozere

If you aren’t absolutely thrilled with The Impact, reply and let us know why. Or you can unsubscribe from all updates by clicking here.

Copyright © The Impact 2021. All Rights Reserved || 19 Morris Ave, Bldg 128, Brooklyn NY 11205