To: The Impact Readers

Greetings! 🧐

Spring seems to be finally here, even though we saw some snow earlier this week in NY. The environment is getting more attention and people have now – hopefully – canceled all of their unnecessary subscriptions and are learning more about the value of saving and resource management.

In your inbox: Electric Vehicle to Grid Connections; Hydrogen’s trek forward as a natural gas replacement; and a utility scale battery project designed to replace gas peaker plants!

Hydrogen fuel cell vehicles and the whole stigma around hydrogen isn’t the greatest. We’ve reported something similar with Volkswagen tearing into the “Hydrogen for passenger vehicles” debate. But we are extremely bullish on the value hydrogen will bring to the decarbonization value “green hydrogen” will bring to the market.

As a more energy-dense & lighter storage source for energy than a lithium-ion battery – the advantages of having access to hydrogen in abundance would be immensely valuable. Recently, another win has occurred for the potential of “green hydrogen” coming into mass circulation in the next decade.

Shell – an oil & gas company that has “showed” signs of transitioning to clean energy – has continued to push forward on their 4 MW – 10 MW offshore wind farm that will be used to produce hydrogen, which should produce close to 800k tonnes of hydrogen annually.

Now, beyond the fact that the project hasn’t been pulled due to the ongoing COVID situation is a good thing – predominantly due to the fact that Shell is looking at this as a long term investment and any 2 to 3-year “downturn” shouldn’t impact those plans if they financially planned it right – this project is coming at the perfect time.

It is timed perfectly with places like London banning future natural gas development from 2025 onward. With natural gas being phased out over the next 5 to 10 years implementation of hydrogen into the UK ecosystem can prove immensely beneficial as a replacement for natural gas due to its “similarities”.

Tesla doesn’t stay out of the news, and nowadays we typically want to avoid the daily digest of Musk’s tweets unless it gives us a way to introduce some progress in a space that is beneficial to the de-carbonization & resilience efforts associated with the Electric Grid. And some results about their pilot in Australia with an integrated Virtual Power Plant solution for their power-walls.

Virtual Power Plants are not a new concept. All it really is – is a way for utility companies and their grid operators to curtail loads when necessary so the grid doesn’t collapse. They do this by tapping into your smart home devices [Google Nest’s, EV Chargers, etc] and turning them off during a demand response period.

Now if we want to consider the leaders in the Virtual Power Plant space we have to consider AutoGrid & OhmConnect. Both companies offer something similar – Autogrid more on the enterprise side and OhmConnect on the residential front.

But there is one key difference between what Tesla and AutoGrid & OhmConnect offer in the Virtual Power Plant space

Tesla is leveraging their PowerWalls [Residential Battery] to reduce demand charges and AutoGrid + Co. don’t require a $15,000 battery pack.

Now for all you seasoned veterans out there – this is absolutely nothing new, but, it is getting a lot of attention and it requires demystifying and digging into. Batteries today – through their inverters – can load shift devices within the home to use less grid power…fundamentally the logic within the inverter is “charge when power is cheap, use battery power when power is expensive”

But Virtual Power Plants are designed for Utility companies, not the homeowner…which is why what Tesla is doing is interesting.

For grid resilience, load reduction and energy management from a utility perspective having access & automated control over hundreds and eventually thousands of small battery packs enables them to handle revolving loads much easier than an AutoGrid – pure software like solution. A fully integrated battery + VPP energy management system is amazing.

However, my hunch is it still won’t be any match for AutoGrid or OhmConnect – being equipment agnostic, but, remain compatible or having the ability to integrate with battery manufacturers out of the box is far more scalable for utilities in this rapid push towards grid modernization.

Vehicle to Grid & Vehicle to Building technology has become a new emerging technology that has come with the rise of Electric Vehicles. The concept is simple – if I am driving around a 100 kWh battery pack in my EV why can’t I use that stored power to run my home or help the utility manage demand spikes on the grid.

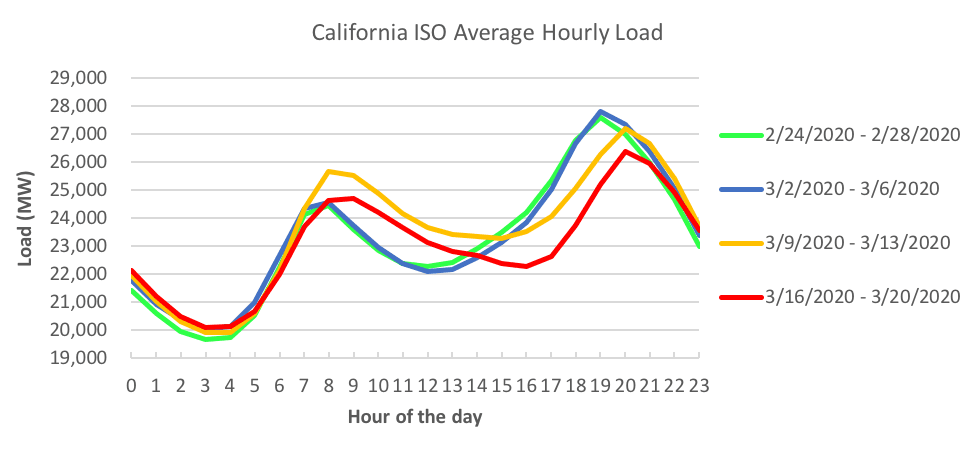

Now from a first principle perspective – the technical advantages of such a solution are huge. As of 2019 about 600k EVs are on the road in CA. Which for simple math purposes we take an average of 50 kWh battery packs per car – we are looking at roughly 30,000,000 kWh of storage capacity roaming the streets. If the utilities have access to that capacity spread across the street during the times residential energy loads spike [evenings] it would mean easing the need for peaker plants to be needed.

The challenge we see – beyond the infrastructure, controls, variability and other implementation challenges – is the incentive structure that would need to be put into place for EV owners to want to participate in a program that does Vehicle to Grid integration. The natural thought is paying for used capacity as a rebate to the vehicle owner or giving free charging credits. However, we also need to understand the added “depreciation” such a program could cause to the EV owner – added cycles on the battery, means more optimization is required within the BMS for the car in order to keep it going for 10 years +. How the utility/state could compensate for the possible downtime an EV owner might face and what it might do to the “value” of the vehicle is something that has to be calculated.

We will put it on our list to dig more into. Interesting space and we are sure there are ways to make the incentive structure work for all involved. The utility shouldn’t spend more to develop that storage & the vehicle owner shouldn’t be losing money at the same time.

Times of crisis mean disrupted supply chains and resource shortages. In World War II US, that meant metal and rubber drives to collect scarce resources to be recycled for military purposes. Salvaged kitchen fat used to produce glycerin for drugs and explosives; pots, pans, car bumpers, and toys being melted down for steel; and “victory” or “war” gardens planted on private yards and public parks produced 40 percent of the country’s fresh vegetables. Those are extreme examples from extreme times (keep your car bumpers on), but they speak to the point that America can recycle and at one time had an established cyclical economy.

COVID19 – as I’m sure you’ve caught on – is a time of crisis. Just consider how our nation is sourcing its masks. Citizens are donating respirator masks they already had to hospitals. People are going out of their way to sewing surgical masks out of extra cloth they have for nurses, neighbors, and relatives. Companies, hospitals, and universities are sterilizing N95 masks for multiple, prolonged use. One surgeon even designed a reusable respirator meant for multiple uses out of a full-face snorkel mask. And the Surgeon General is showing everyone how to make one out of an old tee-shirt.

We’re not getting into the politics of how we ended up here, but it goes without saying that most of these aren’t ideal methods. But in a time with limited grocery runs with product shortages (RE: Toilet paper) many people are getting a crash-course in the three R’s as a way to stretch everything bought further. Hopefully, our crisis doesn’t get worse, but generations that go through crisis generally carry some of those values and habits with them as life returns to normal. And in the decade of action against climate change – we could carry those lessons we’re learning with us forward.

Europe, still on track with the Paris Agreement to limit global warming to well below 2°C, are more committed than ever and are starting the process of phasing out coal plants. What’s going to replace them? Many companies and countries are betting on carbon-free hydrogen.

The Netherlands calculates that gases will still make up 30-50% of final energy use in 2050. As the second-largest “grey” hydrogen producer in Europe and “unique starting position” in the gas supply chain they’re making a plan for carbon-free hydrogen by linking it to offshore wind farms. They’ve also identified current gas pipelines to transport it for use in industry, homes, and transit.

Meanwhile, in Germany, two major energy companies, Uniper SE and Siemens AG, are partnering to develop a hydrogen model to prepare for Germany closing the last of the country’s coal plants. The plan adapts gas pipelines and storage sites to receive hydrogen and investing 1.2 billion euros over the next three years to reduce carbon emissions at their plants.

We may not have a uniform plan for carbon reduction in the States like the EU does, but we have seen a reduction in coal use. Unfortunately, that’s because natural gas is cheaper so we burn that instead…

California is taking a different direction and is making more investments in battery-based grids.

Using battery plants in power peaks is still mostly uncharted territory, but that’s right where the new battery project is aiming. Clean Power Alliance Executive Director Ted Bardacke told Greentech Media, that the goal is to show California that battery plants can handle taking over the peak power role and edge gas peakers out of the market.

The thing to watch in this is the long term economics for a battery based “peaker” solution vs a gas peaker. Batteries have shorter operational life due to the fundamentals behind it but provide a positive environmental impact. As more documents around this project arise we will report further.

The plant is expected to be operational in August 2021, providing power from the northern edge of Los Angeles County in Lancaster.

Tune in to hear Elliot Roth of Spira Inc & Sue Marshall of NetZero discuss how what we eat is affecting climate change. We hear about how investors, consumers and producers should evaluate de-carbonization of our food. And how eating strawberries in the winter isn’t innocent…

Develop your market map of up-and-coming climate startups and market opportunities by subscribing to our weekly newsletter for free.